Topics: Finance and Accounting Transformation, FP&A

Posted on August 27, 2024

Written By Priyanka Rout

The strongest finance teams don’t just prepare budgets — they follow clear FP&A best practices that turn planning into a real strategic advantage. These best practices for FP&A are less about rigid rules and more about building habits that sharpen forecasts, improve agility, and give leadership the confidence to move quickly when conditions shift. In an environment where efficiency and foresight define competitiveness, embedding these practices into the FP&A process is what keeps businesses resilient.

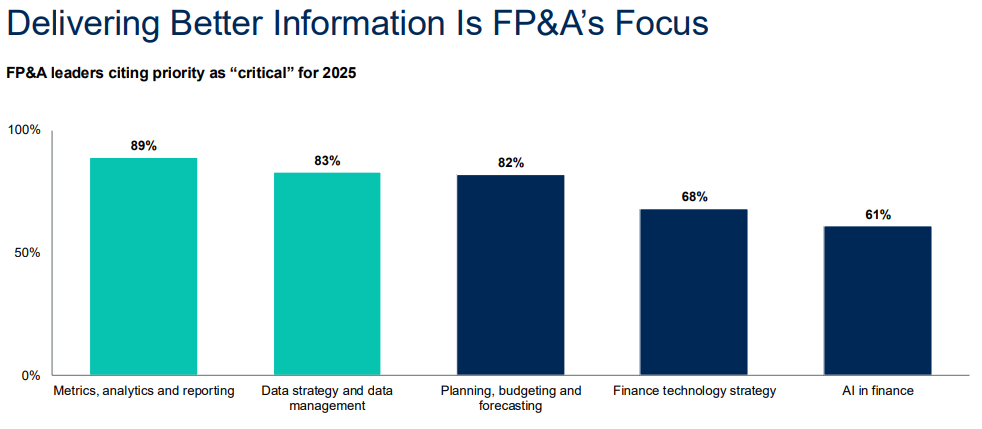

Source: Gartner

Navigating the complex world of business in 2025 requires more than just crunching numbers and making forecasts. It demands a keen understanding of financial planning and analysis (FP&A), which has become the backbone of strategic decision-making.

As businesses strive to do more with less, the implementation of financial planning and analysis best practices is more crucial than ever to optimize financial forecasting and decision-making. To streamline the FP&A process flow within your organization is essential.

At its core, good FP&A work goes beyond preparing financial reports—it’s about diving deep into the data to grasp the ‘why’ behind every financial shift, whether it’s a gain or a loss. This involves crafting detailed forecasts, planning for various scenarios, and spotting opportunities to lessen risks and enhance business agility.

However, there’s a big challenge that many face: teams often get bogged down with routine tasks.

So, how do we shift this balance? How do we ensure our finance teams aren’t just busy, but impactful? The key lies in embracing cutting-edge FP&A tools and refining our financial planning & analysis strategies to free up our teams for higher-value work. This isn’t just about reducing workload—it’s about creating opportunities for meaningful analysis that informs better business decisions. Many forward-looking organizations are already revolutionizing finance with high-end R2R & FP&A services, transforming their finance functions into true strategic enablers.

RELATED BLOG: Drive profitability and care by mastering financial planning & analysis in senior living. Start here now!

In this article, we’ll explore ten essential FP&A best practices that promise not only to enhance operational efficiency but also to elevate the strategic role of finance within your organization.

Source: Gartner

Financial planning and analysis isn’t just number crunching; it’s the roadmap to your business’s future success. Whether you’re managing a quaint local bookstore or a bustling multinational corporation, the insights from FP&A are critical.

What does FP&A really do? It helps you peer into the future using your current financial data, helping you shape business strategies that align with your long-term goals. Imagine running a boutique—FP&A is not only about knowing what’s in the cash register; it’s about using sales data to predict busy periods, plan sales, and set the right prices.

Financial planning and analysis strategies takes you a step beyond everyday accounting. It involves looking at how money moves in and out of your business, identifying trends in customer spending, and understanding how your revenues stack up against your costs. This is not just about keeping your business afloat; it’s about planning for growth and stability.

Adopting FP&A best practices means you’re setting your sights on not just surviving but thriving. With it, you can make smarter decisions, adapt to market changes more swiftly, and position your business for the kind of growth that lasts. That’s why integrating FP&A into your business practices is essential—it turns data into a powerful tool for future-proofing your enterprise.

Explore how outsourcing can transform your financial planning and analysis and boost your business growth.

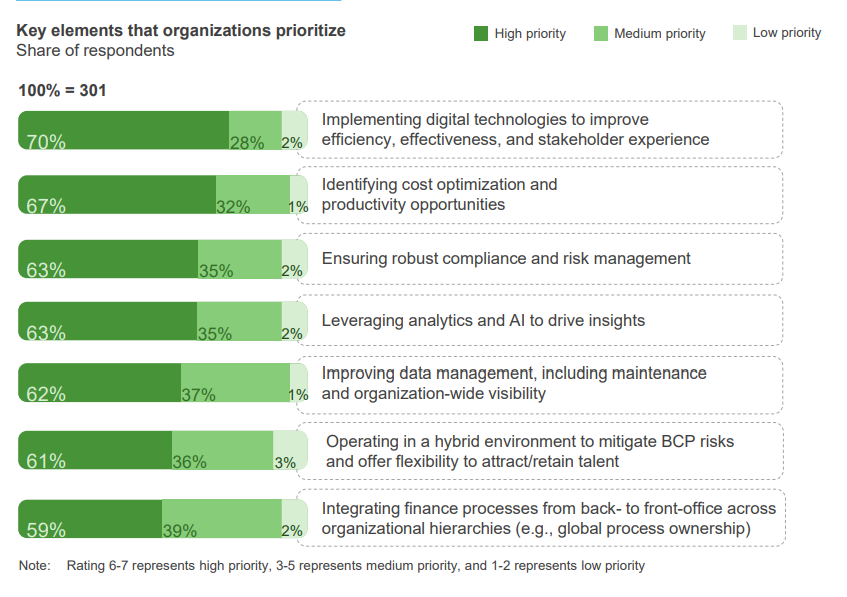

Priority of Key Elements in the Finance Function; Source: WNS

As businesses grow, it’s crucial to prepare for various financial landscapes. Sure, setting a budget based on goals and actual performance is standard, but what about those less likely situations? Imagine slower revenue growth than expected, or difficulties in scaling your sales team. What if a new government policy suddenly increases your taxes next year? These are scenarios where comprehensive planning becomes invaluable.

Effective scenario analysis should consider:

FP&A professionals aren’t just problem solvers; they’re also detectives of financial success. It’s not enough to recognize growth; understanding why it happens is essential. Consider factors like innovation. Does it directly contribute to new sales? Can you influence this driver through internal processes? How strong is the correlation between this driver and your revenue growth? Answering these questions can provide deeper insights into what truly propels your business forward.

Imagine starting a journey without a map. That’s where a Project Plan comes into play. It’s a blueprint for success, detailing milestones and actions essential for achieving objectives. This plan requires seamless collaboration across departments like Operations, Finance, and HR. Using the right FP&A software can dramatically streamline this process, ensuring that everyone is on the same page, facilitating data sharing, and reducing the chances of human error.

Time is precious in business. Focusing on ineffective drivers can divert attention from opportunities that genuinely affect your bottom line. Ensure your team concentrates on drivers that are logical, actionable, and relevant. This approach helps in constructing models that are not only efficient but also adaptable to changing business conditions, enabling more accurate forecasts.

Effective FP&A professionals excel at translating high-level goals into specific, actionable targets. For example, if increasing EBITDA is a goal, you’ll need to outline clear, measurable steps for sales, marketing, and operations to follow. These targets ensure that every department and individual contribute directly towards the broader financial and operational objectives.

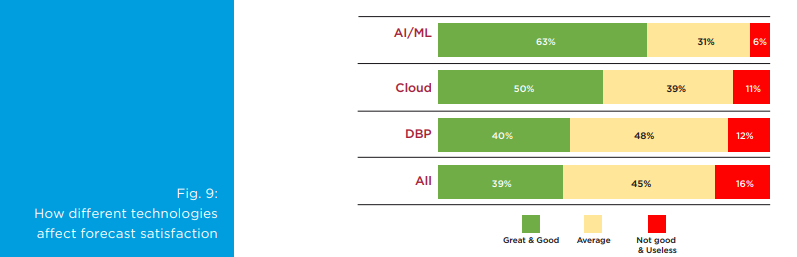

How different technologies affect forecast satisfaction?; Source: FPA Trends

In today’s digital age, having a robust tech stack is fundamental for efficient financial planning and analysis. A good FP&A tool should allow you to easily compare budgets with actuals, build forecasts, and visualize crucial financial metrics. This technology supports FP&A professionals by saving time and enhancing the accuracy of their analyses, reinforcing both financial planning best practices and financial reporting best practices.

RELATED BLOG: Why finance leaders are betting on Invoice Processing: Automation & AI to Define the Future. Read the blog now!

Setting targets is the beginning; the real challenge lies in measuring and achieving them. Define clear KPIs for each target, determine who is responsible, and establish regular reporting intervals. It’s also crucial to have processes in place for adjusting strategies if targets aren’t being met, ensuring continuous alignment with overall business objectives.

Discover how QX helped a PBSA giant cut costs by 50% and improve efficiency through end-to-end F&A outsourcing.

Markets move too quickly for static budgets. Rolling forecasts give finance teams a constantly updated view of performance, helping leaders react faster to shifts in demand, costs, or market conditions. By making rolling forecasts part of the core FP&A best practices, companies replace outdated assumptions with live insights, creating a planning rhythm that balances short-term execution with long-term strategy.

Disjointed systems and siloed data often slow down reporting and distort results. One of the most valuable best practices for FP&A is integrating data from across sales, operations, and finance into a single source of truth. This not only improves accuracy but also enables faster, more reliable analysis. When finance leaders can trust the numbers, they spend less time reconciling reports and more time building stronger financial planning & analysis strategies.

Reports are only as useful as the actions they inspire. Among the most overlooked financial reporting best practices is designing outputs that clearly highlight key drivers and point toward decisions. Instead of overwhelming leadership with data, effective FP&A teams present insights in a structured, action-oriented way—clarifying what happened, why it happened, and what needs to be done next. This shifts reporting from a compliance exercise to a true strategic tool.

To ensure strategic growth and financial oversight, it’s crucial to understand how to build an FP&A function that aligns with your company’s objectives. The above-mentioned FP&A best practices can significantly improve the effectiveness of the FP&A function, but for businesses with a forward-looking approach, a more comprehensive solution may be necessary.

Outsourcing financial planning & analysis can allow companies to focus on their core competencies, gain access to cutting-edge analytics tools & benchmarking data and improve decision-making. Furthermore, outsourcing can provide businesses with the scalability and flexibility needed to adapt to changing market conditions and pursue growth opportunities.

QX Global Group is a leading consulting, automation and BPM company offering comprehensive financial planning and analysis services to businesses across industries and geographies. By leveraging our financial planning and analysis solutions, businesses can establish a team of skilled professionals who can efficiently extract data from key business functions and analyze it objectively.

This service helps companies identify strategic actions that align with their goals and implement them effectively – all at a fraction of the cost of maintaining an in-house financial planning and analysis team.

To boost business performance, FP&A teams really need to sync with other departments. Setting up regular chats to go over financial forecasts keeps everyone on the same page. Adding cross-departmental meetings into the mix can also make financial plans more accurate—imagine getting real-time input from marketing on their next big campaign! Plus, using collaborative tools like Microsoft Teams or Slack can help streamline communication. When everyone gets the big financial picture and how they fit into it, making smart, strategic decisions become a whole lot easier. Strong collaboration is now considered one of the core financial planning & analysis strategies for modern finance teams.

A strong culture of transparency and collaboration is essential for FP&A to thrive. When departments openly share data and align around goals, forecasts become sharper and decision-making improves. Companies that encourage adaptability and a data-driven mindset are also better positioned to embed consistent financial planning best practices across the business.

Keeping your financial data accurate and trustworthy starts with solid governance. Clear rules for how data is captured and shared prevent errors and inconsistencies. Automating integration between systems reduces manual entry mistakes, while regular audits catch discrepancies early. These controls are part of modern financial reporting best practices, ensuring the insights produced by your FP&A team are reliable enough to guide strategy with confidence.

FP&A process transformation refers to the strategic overhaul of the FP&A function to enhance data integration, streamline the FP&A process flow, and adopt FP&A best practices. This transformation aims to improve accuracy, efficiency, and the strategic influence of financial planning and analysis.

The key components of a robust FP&A process include accurate data collection, integrated FP&A processes, effective budgeting and forecasting, and comprehensive financial reporting. Strategic analysis and a strong emphasis on FP&A process improvement are also essential to maintain a dynamic and effective FP&A function.

Typical hurdles include siloed data, outdated tools, and limited collaboration across teams. To overcome these, companies are adopting integrated FP&A software, encouraging cross-functional planning sessions, and aligning around FP&A best practices. Following such financial planning & analysis strategies makes the process more agile and ensures that forecasts directly inform strategic moves.

Rolling forecasts let businesses refresh projections regularly instead of sticking to a static annual budget. This makes it easier to adapt to market changes and identify risks early. For many finance leaders, embedding rolling forecasts has become one of the most effective best practices for FP&A, because it transforms planning into a continuous, strategic capability rather than a once-a-year exercise.

By combining historical data with forward-looking insights, FP&A teams can test multiple scenarios, adjust assumptions quickly, and identify the drivers that truly impact performance. This structured approach is one of the core FP&A best practices, giving leaders forecasts they can actually trust. Embedding consistent financial planning & analysis strategies ensures forecasting isn’t guesswork—it becomes a disciplined process that aligns numbers with business realities.

The most effective finance teams use a mix of BI platforms like Power BI and Tableau, integrated with ERP systems such as SAP or Oracle, to unify data and streamline reporting. Modern FP&A automation tools also enable rolling forecasts, real-time dashboards, and collaborative planning. Choosing technology that supports financial reporting best practices and scales with your business is essential for making automation a genuine enabler of strategy rather than just an efficiency upgrade.

Outsourcing FP&A gives companies access to specialist talent, advanced analytics, and scalable delivery models that are hard to replicate in-house. With experts managing your planning and forecasting, finance leaders can focus on strategic priorities instead of routine processes. Partnering with a provider like QX ensures you’re not only following global financial planning best practices, but also embedding proven outsourced FP&A services that reduce costs, strengthen compliance, and turn financial data into a sharper decision-making tool.

Originally published Aug 27, 2024 09:08:29, updated Aug 28 2025

Topics: Finance and Accounting Transformation, FP&A