Topics: Procure-to-pay cycle

10 Best Practices to Optimize the Procure-To-Pay Process

Posted on August 02, 2021

Written By Priyanka Rout

Let’s Get Started!

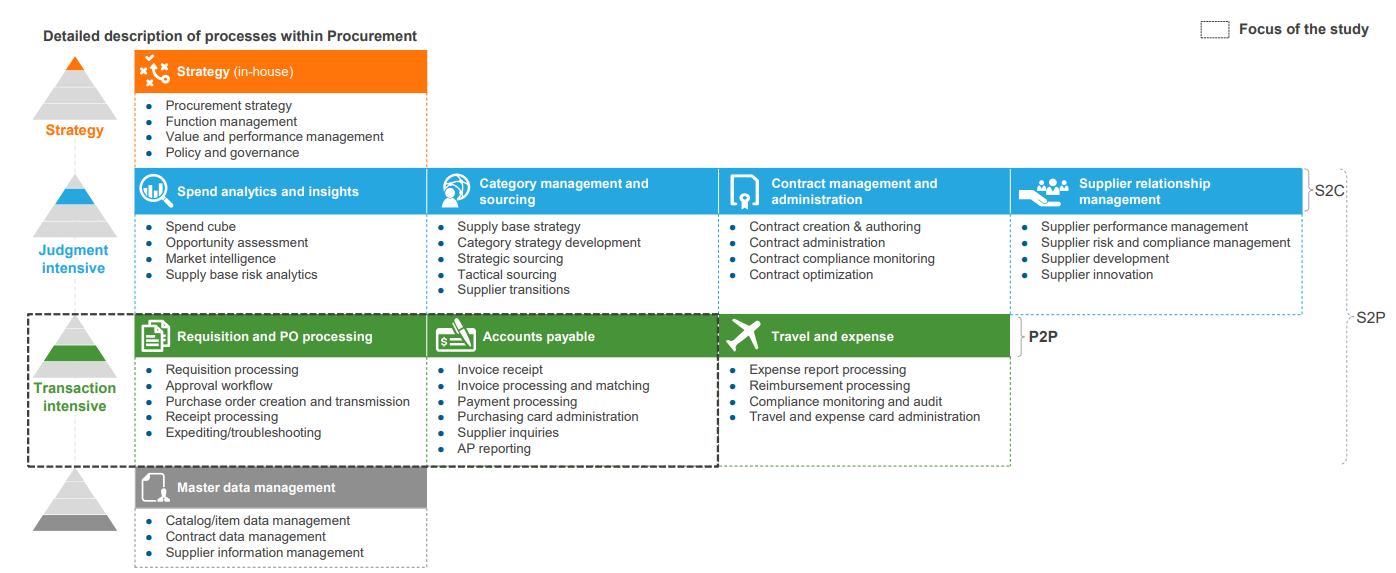

Detailed Description of Processes within P2P; Source: Everest Group

Let’s begin with a stat- The global market for source-to-pay and procure-to-pay outsourcing is growing quickly and is projected to hit $55.8 billion by 2028.

Navigating the complexities of the procure-to-pay (P2P) cycle is crucial for any business looking to stay ahead in the competitive market landscape. An efficient procure-to-pay best practices process is more than just a procedural necessity; it’s a cornerstone of strategic advantage.

However, adapting to the modern shift in corporate spending can be challenging. As noted by Forbes Councils Member Peter Nesbitt, traditional top-down purchasing models have made way for more agile, technology-driven strategies. This evolution requires moving away from the antiquated, manual procurement models, which are often hampered by limited visibility and inefficiency. These outdated approaches can lead to bottlenecks, customer dissatisfaction, and strained vendor relations.

If the barrage of invoices and purchase orders flooding your desk feels overwhelming, know that there’s a way forward. This guide will walk you through every critical step of optimizing the P2P cycle, from requisition to payment, helping you transform your procurement operations into a strategic powerhouse. It will also provide you with the necessary tools and insights to streamline processes, fortify vendor relationships, and achieve substantial cost reductions. Let’s peel back the layers of the procure to pay process best practices and set the stage for substantial improvement.

Understanding Procure-to-Pay

What is Procure-to-Pay?

The procure-to-pay (P2P) process, also known as purchase-to-pay, is a seamless workflow that spans the receipt of goods or services all the way to making payments. It’s an integral part of the larger procurement landscape, essentially bridging the purchasing department with the accounts payable (AP) team.

Components of Procure-to-Pay

Here’s how it works:

- The procure-to-pay process begins with a Purchase Requisition, where goods or services are requested, and the purchasing team ensures alignment with company policies before approving a vendor.

- Next, a Purchase Order is issued to the vendor once the requisition is approved.

- During Invoice Reconciliation, the accounts payable team verifies that the received goods or services match the purchase order and delivery documents.

- Finally, Payment Issuance occurs when the accounts payable team processes payment to the vendor based on agreed terms.

Why is Procure-to-Pay Important?

The procure-to-pay process is crucial because it helps cut costs by minimizing manual labor, enhancing accuracy, and boosting efficiency and financial oversight. An added advantage of this process is that it promotes compliance and organization, crucial for ensuring precise transactions and getting the most out of contract values.

Common Challenges of P2P Cycle

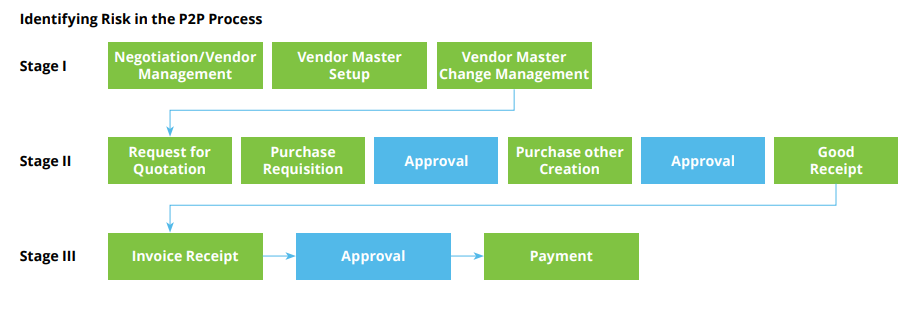

Identifying Risk in the P2P Process; Source: Deloitte

Like any business operation, the procure-to-pay process can face obstacles that disrupt its efficiency. These challenges may arise from various areas such as:

- Implementing new technologies

- Managing and streamlining process integrations, changes, and enhancements

- Ensuring governance and compliance controls

- Handling contract management

- Organizing data

- Reconciling invoices

- Managing the costs associated with invoice processing

RELATED BLOG: Read the blog to see how an ordering system can transform your procure-to-pay process.

10 Procure-to-Pay Best Practices You Should Adopt

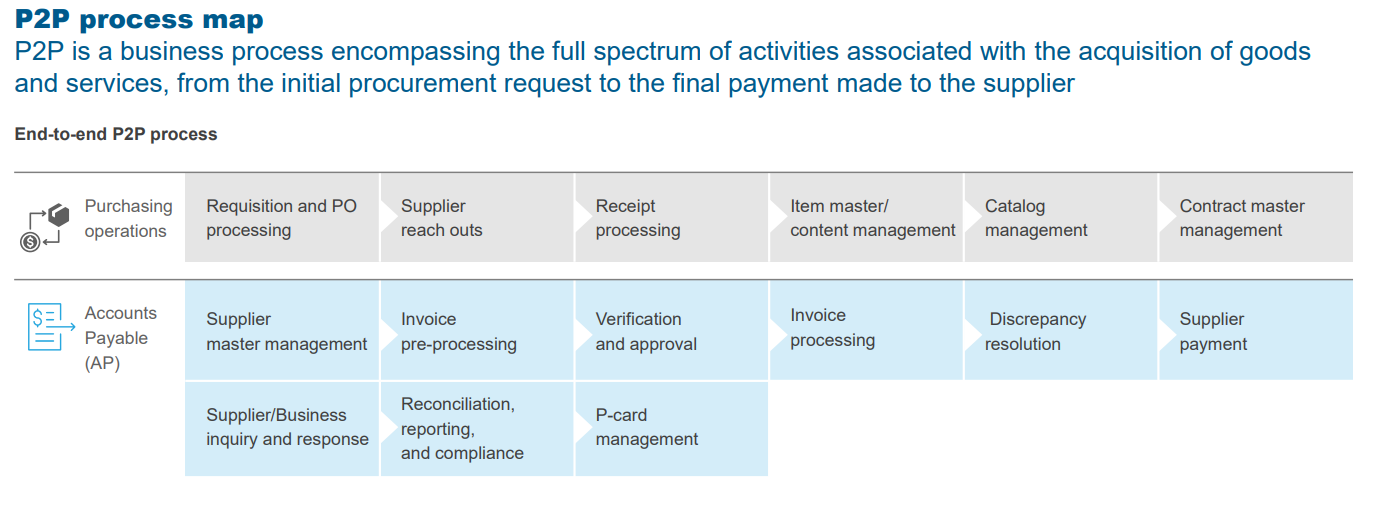

P2P Process Map; Source: Everest Group

Best Practice 1: Implement E-Procurement Tools

eProcurement platforms have become essential for organizations looking to enhance their procure-to-pay lifecycle. By digitizing and automating procurement processes, these platforms deliver several advantages:

- Greater visibility of spending across the company.

- Better adherence to procurement policies and contracts.

- Improved supplier collaboration and communication.

- More efficient requisition and approval workflows.

- Automated creation of purchase orders, increasing both efficiency and accuracy.

Best Practice 2: Centralize Procurement Data

Centralize all information on current and past procurement processes to save time otherwise spent digging through documents or emails to get a handle on a project’s status. This approach not only prevents information from getting lost but also ensures that no steps are overlooked.

Best Practice 3: Standardize and Automate Invoice Processing

Automating the invoice approval process can significantly reduce errors and expedite payment cycles. By automating key parts of the procure-to-pay lifecycle, organizations can overcome these challenges and reap several benefits. Advanced automation technology streamlines the P2P cycle, reducing time, errors, and improving overall efficiency.

Areas of the P2P cycle ideal for automation include:

- Requisition Management: Automating the creation and approval of requisitions, along with their integration with catalogs and contracts, simplifies the entire procurement process.

- Invoice Processing: Implementing advanced solutions for automatic invoice data capture, matching, and routing facilitates hands-free invoice processing.

- Approvals and Workflows: Establishing dynamic approval workflows that operate based on set rules and thresholds helps eliminate the need for manual oversight.

- Payment Processing: Automating the scheduling of payments, generation of remittance advice, and integration with financial systems ensures efficient and timely supplier payments.

Best Practice 4: Develop Strong Supplier Relationship

Strong supplier relationships are key to a well-optimized procure-to-pay cycle. Effective collaboration with suppliers can lead to cost savings, improved product quality, and better operational efficiency.

Organizations can enhance their procure-to-pay lifecycle by working closely with suppliers, fostering open communication and active participation. This collaboration can manifest in several ways:

- Implementing supplier portals for easy exchange of information and documents.

- Involving suppliers early in the sourcing and contract negotiation phases.

- Sharing insights into demand forecasts and updates on order statuses.

- Setting clear performance indicators and establishing feedback loops.

Best Practice 5: Increase Visibility in Your Purchasing Order

Visibility is essential in monitoring the effectiveness of your procure-to-pay cycle. It allows stakeholders to track each purchase throughout the process, creating an audit trail and facilitating data reporting.

Real-time spend data, broken down by line, product, user, or location, empowers your finance team to make informed decisions about your purchases. This advanced level of visibility provides insights into the latest changes in inventory, availability, and purchasing activities. It helps your finance team and other decision-makers adapt to shifts in your procurement operations, ensuring that purchases are made wisely, competitively priced, and compliant with standards.

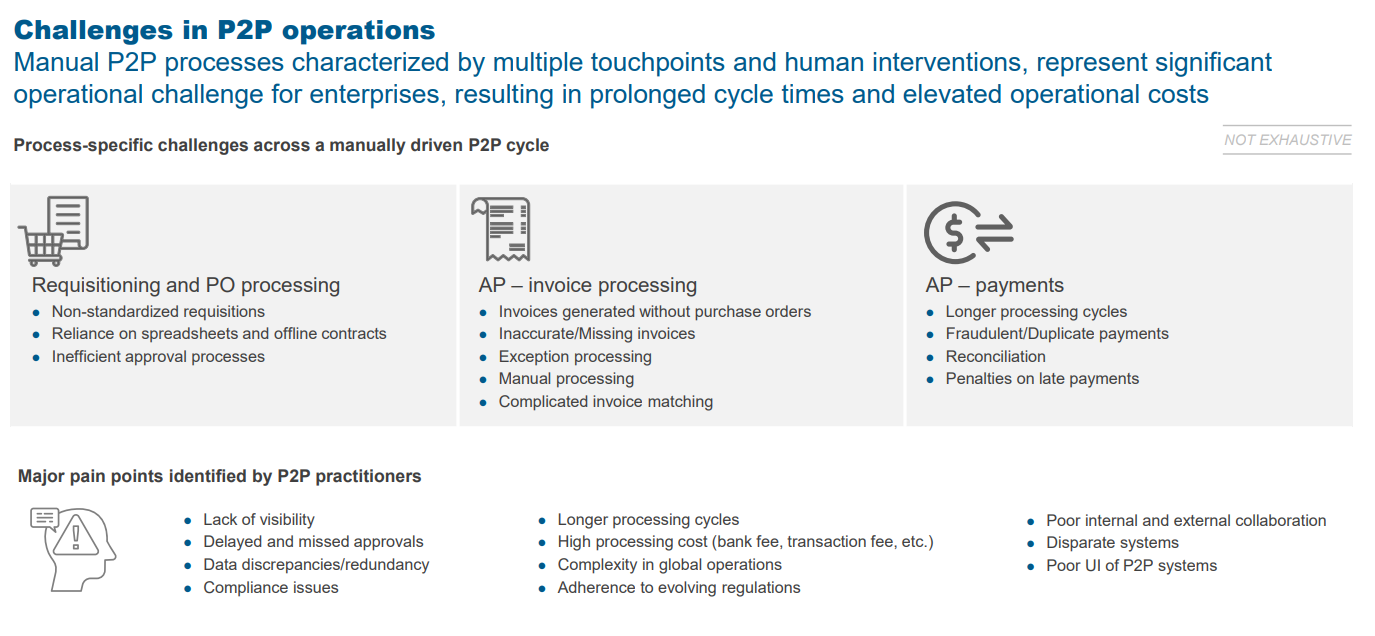

Challenges in P2P Operations; Source: Everest Group

Best Practice 6: Optimize Inventory Management

Optimizing inventory management is crucial for reducing costs and improving cash flow. Here are a few key strategies:

- Implement Just-In-Time (JIT) Inventory: This approach minimizes holding costs by ordering goods only as needed for production or sales, keeping inventory levels low.

- Use Advanced Tracking Systems: Technologies like RFID or barcode scanning can help maintain real-time inventory levels, preventing both overstocking and shortages.

- Conduct Regular Inventory Audits: Periodic checks ensure inventory accuracy, helping to prevent financial discrepancies and improve order fulfillment efficiency.

- Employ Demand Forecasting: Leveraging historical sales data to predict future demand can help adjust inventory more accurately, avoiding excess stock and reducing storage costs.

Best Practice 7: Integrate P2P with Business Systems

Integrating Procure-to-Pay (P2P) processes with other financial and operational systems within a company brings several key benefits that enhance overall business performance:

- Streamlined Operations: Integration allows for seamless data flow between P2P and systems like ERP or CRM, reducing manual data entry and speeding up processes from purchasing to payment.

- Improved Financial Oversight: With integrated systems, financial data is more accurate and visible, making it easier to monitor spending, enforce budgets, and manage costs effectively.

- Enhanced Compliance and Risk Management: Automated compliance checks within integrated systems reduce the risk of errors and fraud, ensuring procurement aligns with company policies.

- Better Decision-Making: Access to comprehensive data and analytics from integrated systems supports more informed and strategic business decisions.

Best Practice 8: Leverage AI and Automation

Artificial intelligence (AI) and automation are transforming the procure-to-pay process, enabling businesses to reach new heights of efficiency, enhance decision-making, and speed up operations. By integrating these advanced technologies, companies can streamline the payment process, minimize manual labor, and reduce cycle times.

Key improvements brought by AI and automation in the procure-to-pay lifecycle include:

- Invoice Processing: AI enhances data capture, matching, and routing, allowing for seamless, touchless invoice processing that cuts down on manual work and quickens the entire cycle.

- Spend Analysis: AI-driven tools provide deep spend classification and data enrichment, offering detailed insights that aid in making informed sourcing decisions and spotting opportunities for cost reduction.

- Risk Management: AI algorithms actively monitor supplier performance, flag potential risks, and offer proactive strategies to avoid disruptions.

Best Practice 9: Continuously Improve and Innovate

Optimizing the procure-to-pay (P2P) cycle is a continuous process, not just a one-off project. To enhance the P2P cycle, organizations need to consistently monitor their performance, analyze key metrics, and make informed adjustments to foster ongoing improvements.

Key performance indicators (KPIs) are essential for pinpointing areas that need enhancement within the P2P cycle. Critical metrics to track include:

- Cycle Time: Duration for processing requisitions, orders, and invoices.

- On-time Payments: Percentage of payments made to suppliers on schedule.

- Maverick Spend and Contract Compliance: Monitoring adherence to procurement guidelines and contract terms.

- Cost Savings: Gains from negotiation and strategic sourcing initiatives.

Best Practice 10: Leverage Spend Analytics

Optimizing the procure-to-pay cycle involves understanding spending patterns, supplier performance, and potential bottlenecks, which can all be better managed through advanced analytics.

This powerful tool enables businesses to make well-informed decisions by offering deep insights into procurement operations. By examining past data, companies can uncover opportunities to save costs, such as:

- Negotiating better deals with suppliers where the company spends the most.

- Buying in bulk to take advantage of volume discounts.

- Cutting down on unauthorized or non-compliant spending.

RELATED CASE STUDY: Discover how QX partnered with a prominent senior living operator, managing over 60 communities across eight states, to optimize their back-office accounting operations.

What’s the Bottom Line?

To wrap up, fine-tuning the procure-to-pay optimization best practices is more than just a routine check—it’s a strategic move that unlocks efficiency and cost savings. By diving into advanced analytics, you gain clear insights that help streamline negotiations, bulk purchases, and compliance measures. This doesn’t just save money; it strengthens your entire procurement strategy.

QX provides a comprehensive suite of outsourced Procure-to-Pay (P2P) services tailored to businesses across various industries. Our offerings include accounts payable, invoice management, purchase order management, and vendor master management, among others. We take a collaborative approach, working closely with our clients to tailor our services to their specific needs. Contact our experts to learn more about how our P2P solutions can benefit your business.

Transforming your procure-to-pay process can turn procurement into a powerhouse that not only supports but also drives your organization’s goals forward. It’s about making your procurement work smarter, not harder, for lasting benefits.

FAQs

What is three-way matching in P2P?

Three-way matching in the Procure-to-Pay (P2P) process involves comparing the purchase order, the received invoice, and the delivery receipt before approving a payment. This ensures the payment is accurate and only made for items ordered and received.

What are the critical metrics to track for evaluating procure-to-pay process improvement?

Key metrics to track P2P process efficiency include cycle time for processing payments, rate of invoice exceptions, percentage of on-time payments, and cost per invoice processed. These indicators help assess the speed, accuracy, and cost-effectiveness of the P2P process.

How can small businesses implement P2P best practices with limited resources?

Small businesses can implement best practices in procure-to-pay by using affordable or free software tools to automate and streamline processes, focusing on training staff in efficient procurement techniques, and regularly reviewing and optimizing supplier agreements and procurement policies.

Originally published Aug 02, 2021 08:08:13, updated Apr 16 2025

Topics: Procure-to-pay cycle