Robotic Process Automation

Consulting and Implementation

Optimise processes, automate manual activities and transform your business operations

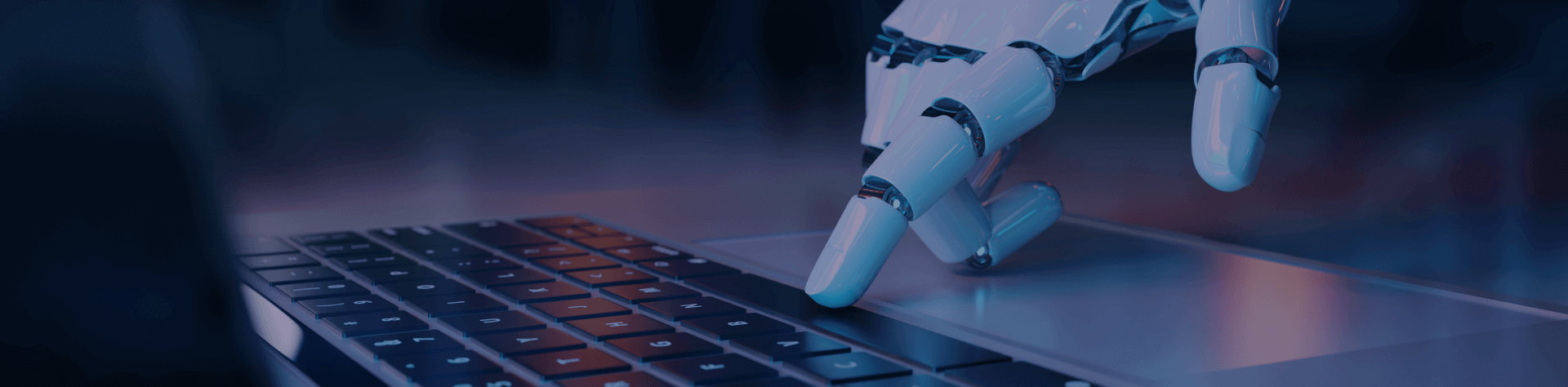

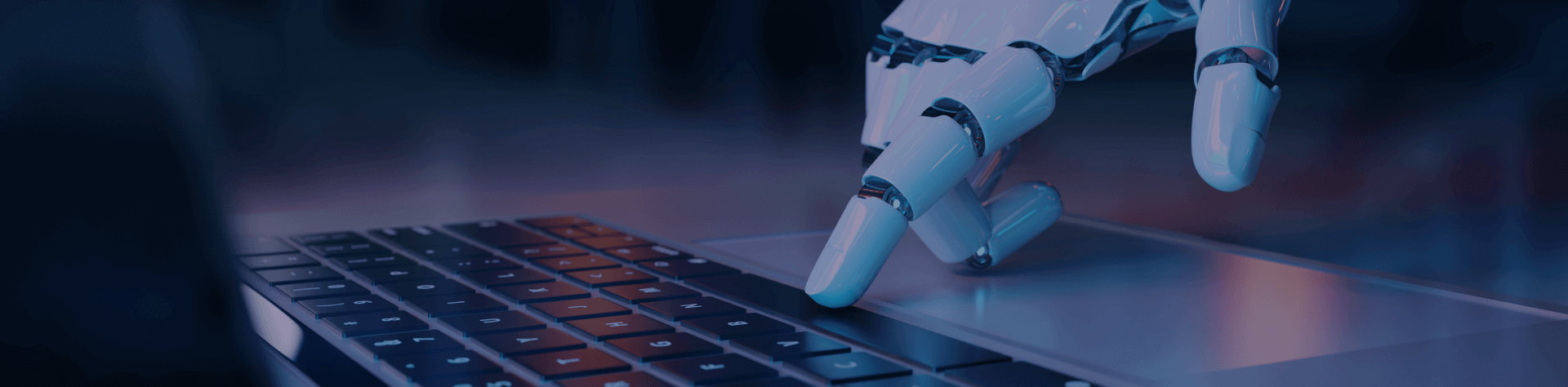

Leverage RPA to Automate Redundant Tasks

The rise of Robotic Process Automation (RPA) is transforming the way work gets done. Organizations that are able to capitalize on the opportunity to build a hybrid workforce of humans augmented by bots will have an edge over their competition.

In the simplest terms, RPA refers to the use of technology to automate repetitive, replicable and rules-based activities. It comprises software bots that interpret, trigger responses and communicate with other systems to perform a variety of repetitive tasks. RPA is a good fit for high-volume tasks that use structured data, e.g., accounting, HR, and administrative tasks.

What Can QX’s RPA Solutions do for Your Business?

RPA Technology Benefits

- Easy to implement and use

- Doesn’t require new IT Infrastructure

- 24/7 availability – bots work round the clock

- Flexible and easy to scale

- High ROI for high-volume functions

Tangible Business Outcomes

- Increases speed and accuracy

- Reduces manual work and improves employee engagement

- Reduced cost of operations

- Productivity and efficiency gains

- Improved compliance

RPA Services and Solutions

RPA is often an important step in accelerating your organization’s digital transformation journey. We leverage AI, ML and analytics to build scalable and results-driven RPA solutions. Our comprehensive solutions focus on well-defined benefits and tangible result, ensuring the success of your RPA project.

Robotic Process Automation Implementation

- Assessment of automation opportunities

- Implement Productive Pilots

- Develop a strategic automation roadmap and business case

- Design, build and deploy operating model

- Vendor selection

- Complete end-to-end roadmap

RPA Control Tower

- Maintenance

- Support & Troubleshooting

- Monitoring

- Analysis

- Dedicated Account Management

- Enhancements & updates

RPA CoE & An Operating Model

- Develop a robust operating model

- Establish a Center of Excellence (CoE)

- Determine appropriate metrics and measures

- Finalize the RPA governance framework

Intelligent Document Processing

- Transform unstructured and semi-structured data into usable data

- Extract Data from a variety of document formats

- Use Optical Character Recognition (OCR)

- Orchestrate with RPA to automate end-to-end document centric processes

RPA Process Suitability & Business Case

- Develop Robotic Process Automation Assessment Framework

- Conduct a process suitability assessment of core processes

- Identify both candidate processes for RPA as well as for other transformation

- Facilitate a stakeholder review to prioritize and select candidate processes

- Develop an Automation Roadmap

- Develop a robust RPA business case

- Define the future expansion of RPA services

Chatbots

- Use voice, text or hybrid chatbots for Artificial Intelligence (AI) conversations

- Trigger bots to do things using no-code AI powered chatbots

- Communicate with customers in any language using Natural Language Processing

- Let your employees work on one application and use a chatbot to delegate tasks

Bots Development

- Process Suitability

- Process Design (Existing versus Future)

- Solution Definition

- Design and Build

- Integrated Test

- Production & Hypercare

Our Robotic Process Automation Partners

We work with the leading RPA providers across the globe to help you design bots that solve real problems and to train your team on how to use, monitor, maintain the bots.

QX’s Suite of proprietary

RPA Solutions

Combining our industry expertise and technological capability, we have built several ready to deploy RPA solutions catering to the finance, accounting, payroll and recruitment sectors. Our key products include:

Schedule a no-obligation consultation

Schedule a complementary 30-minute consultation with us to know how we can help achieve your Robotic Process Automation goals.

Book a Consultation