Topics: Order-to-cash cycle

O2C KPIs for Business: A Quick Guide (INFOGRAPHIC)

Posted on December 28, 2023

Written By Miyani Lourembam

Order-to-cash (O2C) is a critical and multifaceted process that intersects with every functional area within an organisation, be it sales, finance, or customer support. A thorough examination of O2C data helps detect previously hard-to-spot trends in mistakes, revenue loss, and issues affecting customer satisfaction. Additionally, the billing and accounts receivable aspects of the O2C process are crucial in defining the company’s cash inflow.

Collection delays can lead to complications in accounts payable, payroll, potential acquisitions, and other liquidity-related challenges. Therefore, effectively handling a dependable and steady O2C process demonstrates that your organisation is versatile and skilled in multiple areas.

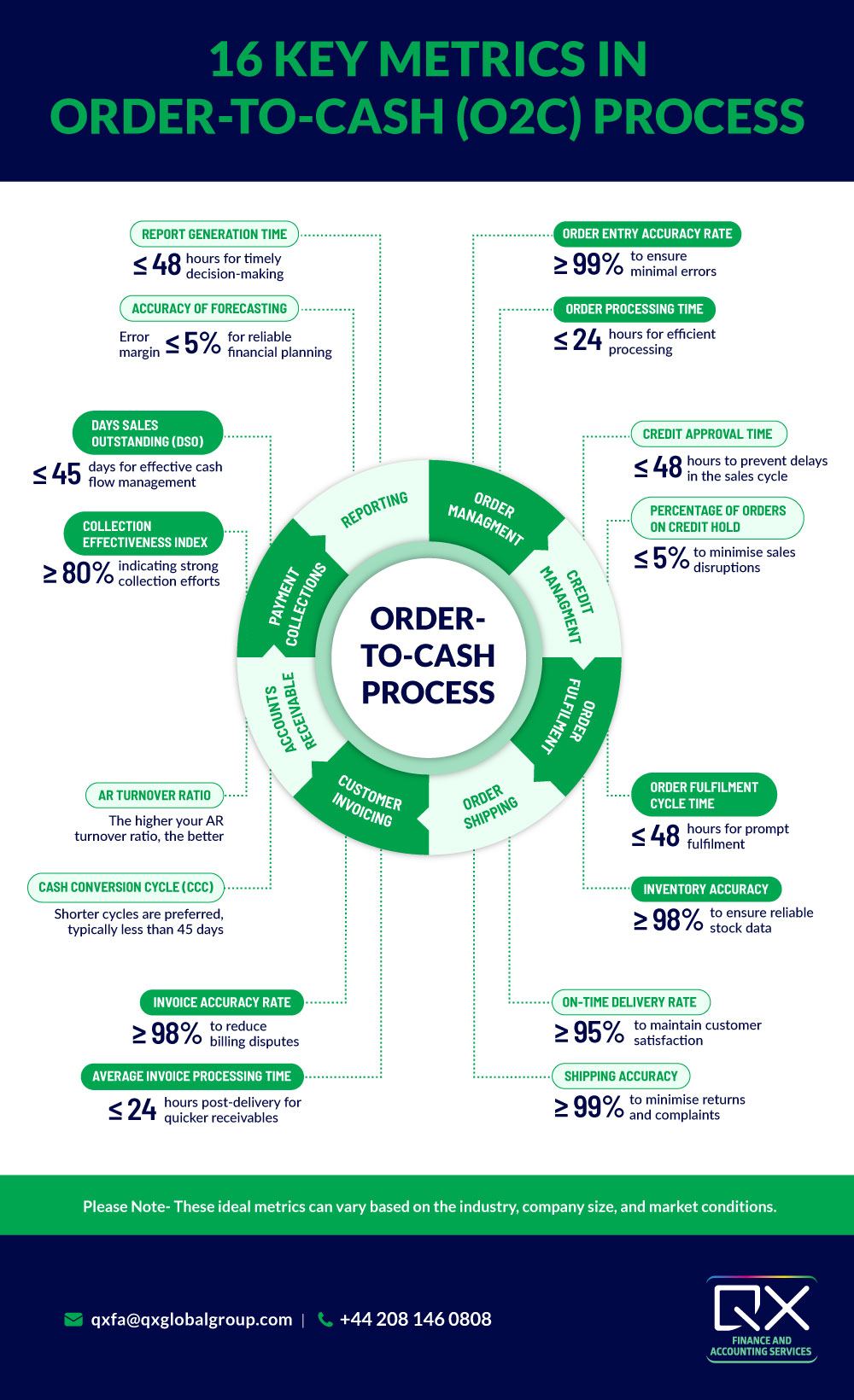

Building on this foundation, our infographic will delve into the essential O2C KPIs every business must monitor for an efficient O2C process.

16 Important Order-to-Cash (O2C) KPIs in Business

Regularly measuring and analysing these KPIs can help businesses identify areas for improvement, enhance customer experiences, and improve cash flow and profitability. It is essential to understand that the ideal metrics can vary based on the industry, company size, and market conditions. Handling these KPIs can be challenging, and that’s where O2C outsourcing can be a strategic decision.

Discover how QX helped optimise the O2C process for a leading recruitment giant through bank download automation. Read the case study now!

What’s the Bottom Line?

Outsourcing can relieve your team of this complexity, allowing them to concentrate on their core responsibilities while ensuring that your O2C operations are both efficient and effective.

Also, it is advisable to engage with O2C outsourcing partners or analysts for a more tailored and accurate assessment of what constitutes an ‘ideal’ KPI for a specific business or industry that has expertise in the area of O2C processes and can provide data that are specific to the relevant market and operational context.

FAQs

What is KPI in O2C?

KPI in Order-to-Cash (O2C) refers to key performance indicators that measure the efficiency and effectiveness of the O2C process, helping businesses monitor their financial health and operational success.

How do you optimise the O2C process?

Optimising the O2C process involves streamlining workflows, automating manual tasks, improving data accuracy, and regularly reviewing performance metrics to identify and address inefficiencies.

Why are O2C KPIs important for business?

O2C KPIs are crucial for businesses as they provide insights into cash flow and collection efficiency, enabling better financial planning and decision-making to enhance overall business performance.

Originally published Dec 28, 2023 03:12:42, updated Apr 16 2025

Topics: Order-to-cash cycle