Topics: Process automation

Robotic Process Automation: Top 10 Finance & Accounting Functions Ripe for Transformation

Posted on July 21, 2020

Written By QX Global Group

What is RPA (Robotic Process Automation), and how exactly does it impact F&A processes? AIIM Org defines RPA as: “the term used for software tools that partially or fully automate human activities that are manual, rule-based, and repetitive.”

As a CFO, Finance Director, or Finance Manager, you would agree that the terms “manual, rules-based and repetitive” apply perfectly to a number of activities that finance & accounting departments performs. As an F&A outsourcing company, we definitely see a lot of processes and steps in workflows to which these labels can be applied.

However, much as we would like to believe that finance organisations or finance departments within organisations are jumping aboard the digital bandwagon and doing well, the truth is somewhere in between.

However, much as we would like to believe that finance organisations or finance departments within organisations are jumping aboard the digital bandwagon and doing well, the truth is somewhere in between.

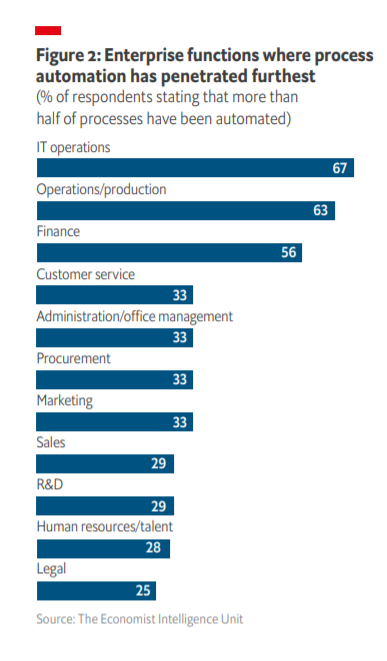

How does RPA Impact Finance & Accounting Operations? This technology has the potential to improve productivity, deliver cost savings and streamline processes, allowing the team members to spend more time on higher-end activities. As the chart below shows, it has already gained wide acceptance in Finance and Admin sectors.

Many organisations are saddled with disparate systems within the accounts and finance spectrum wherein they use different tools for different tasks, and there is a lack of synchronisation between these tools. There is also a case wherein the decision makers don’t really know which modernisation applications to pick.

This means, despite digitisation, the reliance is on manual accounting processes and spreadsheets, which results in additional costs, increased man-hours, inaccuracies, and audit concerns.

This is where RPA in finance and accounting can help. The deployment of RPA in accounting results in large-scale automation of manual finance processes, which allows finance and accounting to deliver more business value.

So, where exactly does RPA fits into the finance and accounting ecosystem? Let’s take a look.

Related Blog: Transforming finance operations: How FCOEs can help CFOs make a difference →

Automation finance & accounting operations

Digitised F&A function means a faster and more streamlined system that helps you achieve much needed compliance and brings down administrative and process costs. This means the finance team has more time on its hands to focus proactively on the strategic aspects of finance that are critical for business growth.

1) General Accounting

RPA can automate general accounting processes that include manual journal entries, fixed asset accounting, financial close activities, and more. The idea here is to automate those financial activities that require little or no human intervention because they subscribe to a series of concrete rules. E.g., data can be extracted from bank statements and entered into reconciliation management templates.

2) Sales Ordering and Invoicing

Tedious and repetitive sales inquiries can be automatically entered into designated spreadsheets or an interlinked SaaS platform. The bot can update details of new customers and also update inventory records upon initiation of delivery. Automation can also help prepare a sales invoice from the sales order, plus post revenue entry into the system.

3) Bank Reconciliation

Another tedious and repetitive process is extracting relevant ledgers and cross-referencing balances from bank statements into these ledgers. This can be handled by the RPA bot, which automatically logs into different bank accounts and the ERP system to prepare bank reconciliation statements in the pre-defined format.

4) Payroll

Payroll, with all the regulatory compliance requirements, hourly rates that differ based on the time of the day and the nature of assignment and timesheets that can come in from different locations can be a remarkable time-intensive activity. With RPA and/or digitisation, a lot of paid can be taken out of the process.

5) Fixed Asset Management

The integration of AI and ML with advanced RPA technology has led to the emergence of intelligent RPA bots that can acquire quotations from prescribed vendors and immediately prepare a report that compares multiple quotations. These bots can also prepare fixed asset budgets and additions of disposal reports. They can also manage fixed asset register reconciliations.

6) Inventory Management

You will be surprised to know that RPA can essentially take care of a large portion of the inventory management process, especially price calculation, quantity variance, report generation, inventory verification and performance matching. It can also automate the shipping process, perform calculation and post year-end adjustment entries.

7) Financial statement and closing

RPA can also help update comparative figures for financial statement, analyze financial statement and ratio, post regularly, yet repetitive closing entries, and do a whole lot more.

8) Planning, Analysis and Reporting

Another area where RPA can be beneficial is preparing certain sections of the yearly, quarterly or monthly financial reports. Data aggregation is a component of reporting that takes a lot of time, and RPA is perfectly placed to take this duty off the shoulders of harried financial analysts. Other aspects of the financial year planning and reporting that can be taken over by RPA include profit and loss statements, cash flow, preparation of management reports and regulatory reports.

9) Receivables Management

RPA bots can monitor your receivables and send reminders to customers for outstanding balances; at the same time, these can calculate the provision for doubtful debts as per company policy and also post journal entries with respect to the related provisions and payments

10) Payables Management

A bot can cross-check various documents for payment verification, monitor all outstanding balances, compile a comprehensive list of accounts payables and also prepare and post year-end adjustments.

Related Case Study: Automating accounts payable using robotic process automation and cognitive solutions →

Learn how RPA can Support your F&A Transformation Efforts

While Robotic Process Automation is definitely not the silver bullet that many had hoped for, it can deliver significant benefits when deployed judiciously. Our team of F&A Transformation experts would love to share their insights with you and answer your questions. Feel free to get in touch with us with your questions, ideas or challenges.

Originally published Jul 21, 2020 12:07:11, updated Jul 17 2024

Topics: Process automation