Topics: Finance and Accounting Transformation, Hospitality Accounting

Posted on September 24, 2024

Written By Priyanka Rout

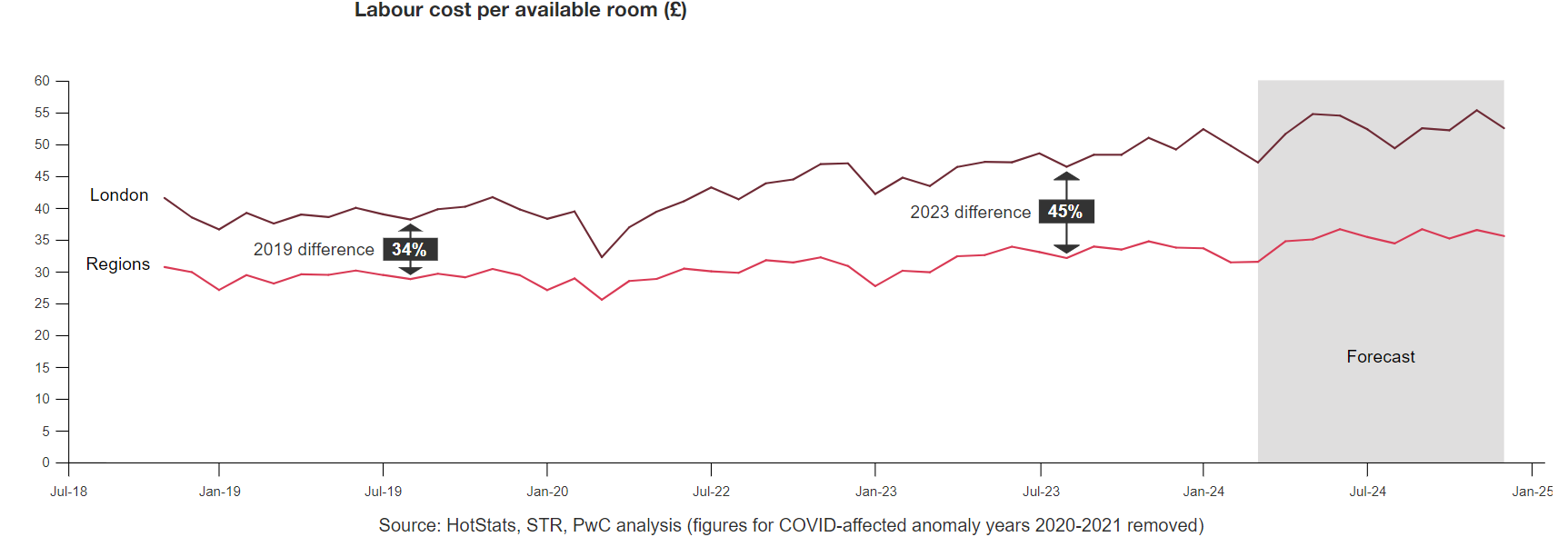

The hospitality industry is at a crossroads. As we move away from the shadow of the pandemic, we’re seeing labor costs in hotels, restaurants, and resorts climb faster than a room service order on New Year’s Eve. This uptick is more than just a line item on a balance sheet; it’s a trend that’s reshaping how the entire sector operates.

Labour Cost per Availability; Source: PwC

The industry’s doors are swinging wide open again, bringing in waves of diverse talent and fresh opportunities. But this reopening comes with its own set of challenges, primarily the rising operational costs in hospitality industry linked directly to staffing. These aren’t just about higher wages; they also fold in the costs of training and sticking to new health guidelines.

Let’s take a closer look at how there’s been a rise in labour cost in hospitality industry. Before the pandemic, these expenses were a concern, yet they were kept in check by traditional cost-management practices. COVID-19 turned this on its head, slashing staffing levels overnight. Now, as the industry rebounds, it’s not just about bringing back jobs.

The competition for keeping good staff is fierce, leading to higher wages and better benefits. High hospitality staff turnover in the UK is driving businesses to focus on retention strategies and improved employee engagement to maintain operational stability.

Rising staffing costs can manifest in various ways across different industry. Here are some examples that highlight how these costs are impacting businesses:

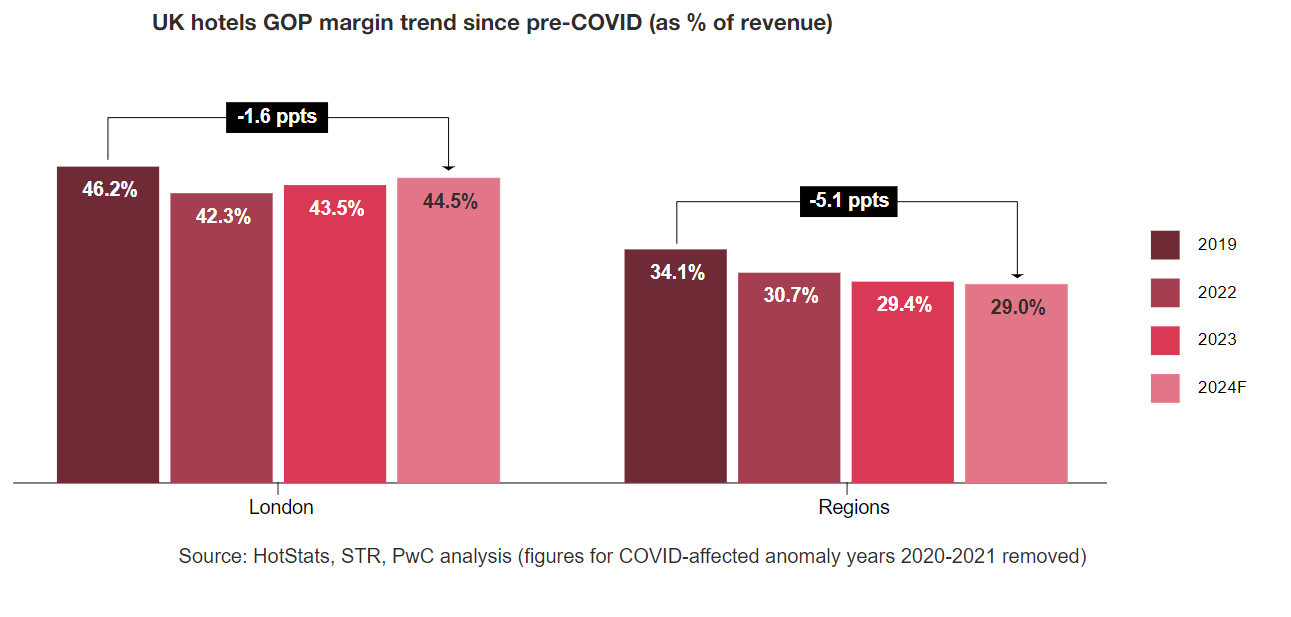

UK Hotels GOP Margin Trends; Source: PwC

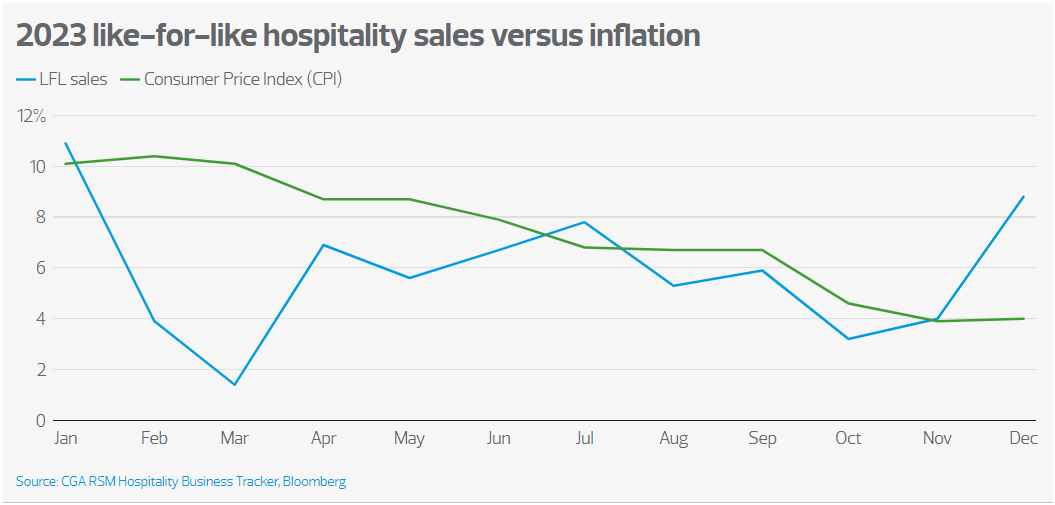

Hospitality Sales vs. Inflation; Source: RSM UK

Unlock the key to hotel financial success with essential KPIs and actionable insights. Read our latest blog!

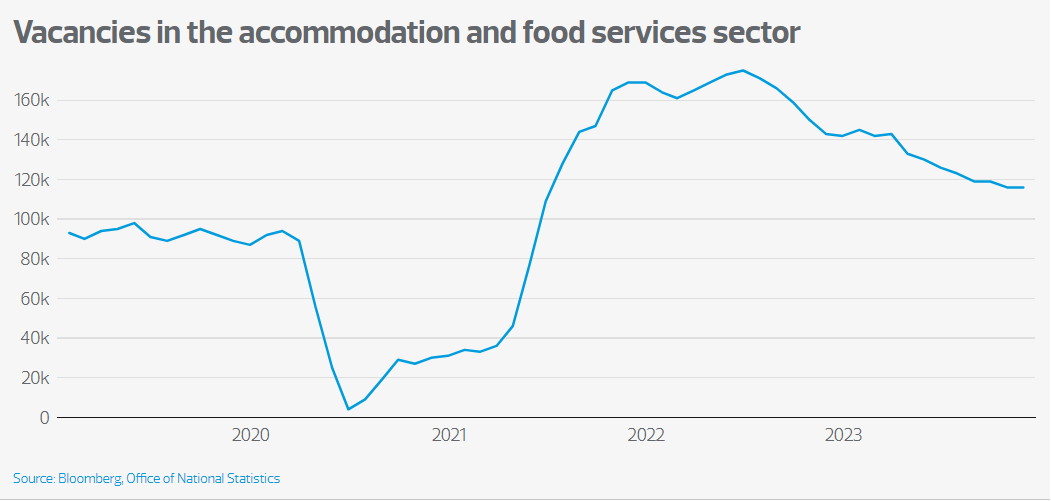

Vacancies in Accommodation and Food Services Sector; Source: RSM UK

In the hospitality sector, using historical data to anticipate future needs can really make a difference, especially when dealing with the highs and lows of tourist seasons. Hotels, resorts, and other businesses can look back at past trends in bookings and visitor numbers to get a good sense of what’s coming.

This insight allows them to adjust everything from staff numbers to room availability, aligning their resources with expected demand.

For finance teams in hospitality, adopting a dynamic budgeting approach is vital. Gone are the days of rigid annual budgets that don’t account for the unpredictable swings in tourist activity.

Instead, a flexible budget that can be updated throughout the year helps businesses stay nimble. By constantly revising their financial plans to reflect the latest market conditions, they can ensure spending aligns with incoming revenue.

Diversifying revenue streams is crucial for both stabilising and expanding your business. By digging into the data to see what’s working and what isn’t, finance teams can uncover trends and grab new opportunities.

It’s about getting a real handle on what drives your business and using that insight to focus on what’s profitable, fix what’s lacking, or drop what’s dragging you down. This approach smooths out operations and impacts cost management in hospitality industry.

Leveraging technology can supercharge these efforts. Modern financial tools give you a crystal-clear view of your revenue streams and let you make quick pivots as market conditions change.

Whether it’s negotiating sharper deals with suppliers, tightening up inventory, or tweaking service offerings to reignite customer interest, these tools keep you agile and proactive, ensuring your business doesn’t just run—it thrives.

Switching to automated payroll streamlines payroll processes, reducing costly errors and unnecessary overhead. By eliminating manual tasks, businesses save time and labor costs while allowing the payroll team to focus on more strategic work.

This shift also makes adapting to changes in workforce size or payroll policies much smoother and more accurate.

Integrating automated payroll with accounting software enhances financial reporting and ensures precise data. It automatically updates payroll transactions, increasing transparency and aiding quicker decision-making.

The system’s analytics help finance teams plan budgets more effectively, aligning payroll with overall business strategy for long-term cost savings.

Overtime can be a big expense, so managing it effectively is crucial for keeping a company’s budget in check. By closely examining overtime costs, businesses can spot when and where it’s being overused.

This helps them adjust staffing schedules to ensure overtime is truly necessary and beneficial. It’s about making sure that overtime isn’t just a habit, but a strategic decision that aligns with the company’s actual needs.

Automated systems are really helpful here. They require managers to approve overtime hours beforehand, which keeps everything within budget. These systems also send alerts if the budget is close to being exceeded, helping prevent financial surprises.

Additionally, using forecasting to predict busy periods helps companies plan for and budget overtime more effectively.

Shifting to remote work can significantly help in cost management in hospitality industry, especially when it comes to saving on office space and utilities. This move not only reduces the expenses tied to maintaining a physical office but also leads to a more streamlined operation overall.

However, it’s important for businesses to consider how this change might affect team collaboration and morale. The key is finding a balance that maintains team cohesion and productivity while still capturing the financial benefits of going remote.

Although this requires some investment, the payoff includes not just cost savings but also a more adaptable and productive workforce.

With rising operational costs in hospitality industry, businesses are turning to outsourcing as a smart way to reallocate tasks like finance, accounting, and payroll. By handing these functions to specialists, hotels and restaurants can significantly reduce labour costs, while also cutting down on the need for extra space and tech setups that come with maintaining a larger in-house team.

Outsourcing firms that focus on hospitality understand the industry’s unique financial needs and seasonal fluctuations, making them ideal for handling complex tasks like regulatory compliance and financial management.

QX Global Group excels in transitioning hospitality F&A Function to advanced digital processes, offering long-term cost savings and operational efficiency. Reach out to learn how our solutions can elevate your business and boost your competitive edge.

Discover how outsourced finance teams are transforming the hospitality industry. Read more in our latest blog!

To wrap things up, the hospitality industry is really feeling the pinch from rising staffing costs, but it’s sparking some creative solutions. From leaning into tech to outsourcing cleverly, these strategies aren’t just about cutting costs—they’re about working smarter.

Staff shortages and retention in the hospitality industry have become major challenges, prompting businesses to implement better training programs and employee incentives to retain talent.

This shift could actually make the industry more efficient and guest-friendly than ever before. So, despite the challenges, it’s a pretty exciting time for hospitality leaders who are ready to innovate and adapt.

RELATED BLOG: Get your game plan ready—find out how hospitality leaders can prepare for 2025 effectively.

To handle rising labour costs, businesses might tweak work schedules, boost staff training to ramp up productivity, or use tech to handle routine tasks more efficiently.

Keeping employees around longer helps avoid the hefty costs of hiring and training new staff, plus seasoned workers tend to work more efficiently.

By outsourcing areas like IT and HR, companies can cut back on the expenses of maintaining full-time, in-house teams and lean on the efficiency of experts.

New laws, such as higher minimum wages or added employee benefits, push up staffing costs. Companies might need to fine-tune operations or adjust pricing to cope.

To improve cost management in hospitality industry, businesses are turning to dynamic budgeting, payroll automation, outsourcing non-core functions, and optimizing revenue channels. These strategies reduce overhead while maintaining guest satisfaction and operational agility.

The rising operational costs in hospitality industry are driven by increased minimum wages, staffing shortages, higher training expenses, inflationary pressure on goods and utilities, and evolving compliance requirements tied to health and safety standards.

The cost of turnover in hospitality industry is significant, with expenses tied to recruitment, onboarding, training, and productivity loss. High turnover also impacts service quality, forcing businesses to invest more in retention and re-skilling efforts.

To manage labour cost in hospitality industry without affecting service, businesses can automate payroll, forecast staffing needs based on seasonality, cross-train employees, and outsource back-office roles. These steps control costs while maintaining a high guest experience.

Staffing in hospitality industry is challenged by high turnover, skill shortages, rising wage expectations, and the need for flexible scheduling. These issues often strain operations, making it difficult to retain talent and ensure consistent service delivery.

Originally published Sep 24, 2024 01:09:21, updated Sep 19 2025

Topics: Finance and Accounting Transformation, Hospitality Accounting