Topics: Finance and Accounting Outsourcing Services, Order-to-cash cycle

Posted on July 02, 2024

Written By Priyanka Rout

Order-to-cash (O2C) is the backbone of a company’s order processing system, encompassing everything from receiving a customer’s order to recording the final payment in the company’s ledger. This critical process begins with order receipt, followed by fulfilment and shipment. If payment isn’t received upfront, an invoice is generated and sent to the customer, and upon payment, the transaction is duly recorded.

Despite its importance to a company’s bottom line, the O2C process is often manually handled. This approach is cumbersome, resource-intensive, time-consuming, and prone to errors, leading to delays and inefficiencies that can negatively impact Days Sales Outstanding (DSO), cash flow, compliance, and customer satisfaction.

Order to cash process outsourcing companies address these challenges by deploying advanced technologies. By leveraging order-to-cash Robotic Process Automation (RPA), artificial intelligence (AI), and analytics, they transform the O2C cycle. RPA helps automate routine tasks, while AI provides intelligent insights and decision support, enhancing the speed and accuracy of the process. Moreover, integrating these technologies ensures a consistent and streamlined workflow, significantly reducing errors and operational costs.

In today’s unpredictable business landscape, exceptional efficiency is crucial. Data reveals that process inefficiencies can cost companies 30% of their annual revenue and waste 26% of an employee’s workday—significant losses by any measure.

However, the integration of workflow automation technology offers a promising solution. By synchronising data between applications and expediting time-consuming processes, businesses can achieve rapid efficiency improvements. Automation in the order to cash process outsourcing can create a frictionless experience for both customers and employees, ensuring a seamless journey from order placement to payment realisation.

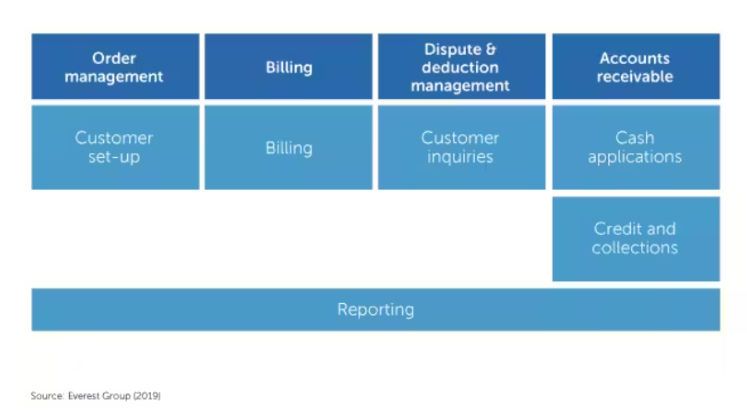

The Everest Group views business processes within order-to-cash as critical for optimising financial performance and operational efficiency; Source: Everest Group

O2C services automation uses technology to streamline the order-to-cash cycle, from order entry to payment reconciliation. This reduces errors, improves efficiency, and speeds up processes, saving time and resources while preventing revenue loss. It is essential for enhancing a company’s operational and financial performance.

The need for O2C automation is clear as businesses struggle with the complexities and errors of manual processes. Manual order entry and outdated systems cause mistakes, delays, and revenue loss, cutting pre-tax income by 5%.

Communication gaps between departments such as sales, fulfillment, and finance can cause further issues, leading to misunderstandings and delays. Manual processes increase billing errors, resulting in disputes and chargebacks. With nearly 30 sub-processes, the O2C cycle is prone to errors, record-keeping issues, and regulatory non-compliance.

Automation can boost revenue by 10-15%, transforming the inefficient O2C process into one of optimisation.

Companies often prioritise branding and marketing, overlooking the O2C (Order-to-Cash) process. However, O2C plays a crucial role in customer experience and cash flow. Here’s why optimising O2C is essential:

Automating the order-to-cash (O2C) cycle can significantly improve the process. By replacing paper methods with document scanning and data capture technology, businesses can digitise documents for easier storage, retrieval, and sharing, while reducing manual errors and delays.

Sales order automation software streamlines order creation, processing, and management, providing real-time inventory updates for accurate fulfillment. Intelligent workflow systems automate order routing based on inventory, priority, and shipping constraints, resulting in faster and more precise processing.

Integrating invoicing software with the sales order system enables automatic invoice generation upon order completion, reducing billing delays and ensuring accurate application of pricing rules and discounts. These automation tools minimise manual work, enhance accuracy, speed up processes, and improve the entire O2C cycle, leading to higher productivity and better customer satisfaction.

Automating your order-to-cash (O2C) process significantly boosts efficiency and profitability, with companies often seeing up to a 200% return on investment in the first year. Traditional systems, reliant on manual labor and suited for physical products and upfront payments, falter as companies grow or adopt new models like pay-per-use services. Automated O2C solutions eliminate manual work, ensuring accuracy, scalability, and streamlined operations across the organisation.

Explore our latest insights on enhancing your O2C cycle. Read our blog to discover effective strategies for mitigating risks today!

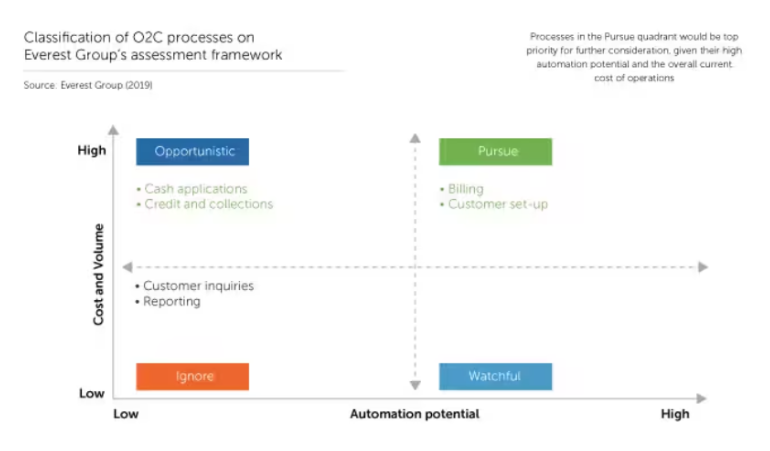

The Four Quadrants of Automation Opportunities; Source: Everest Group

The Everest Group uses a special method called the “Enterprise Value Chain Approach” (EVCA) to determine which business processes are suitable for automation. This five-step method helps companies identify their processes, analyse them, find high-value automation opportunities, and set priorities using specific metrics.

Processes are scored using EVCA and categorised into four groups based on their potential for cost savings and automation:

CFOs are under increasing pressure to optimise financial operations and improve efficiency. Order-to-Cash (O2C) processes are critical in this context, as they directly impact cash flow and overall financial health. Leveraging cutting-edge tools and technologies can significantly enhance O2C outsourcing, driving better performance, scalability, and security.

Cloud-based O2C platforms offer unparalleled benefits for scalability and data security. These platforms allow businesses to manage their O2C processes with greater flexibility, ensuring they can quickly scale operations to meet increasing demand. Moreover, cloud solutions provide robust data security measures, protecting sensitive financial information from cyber threats.

Example: Coca-Cola adopted cloud-based O2C solutions to handle their extensive global operations more efficiently. By leveraging the cloud, they achieved faster processing times, improved data accuracy, and enhanced security, ultimately leading to better cash flow management.

Data analytics and reporting tools are indispensable for gaining real-time insights and tracking performance in O2C processes. These tools enable CFOs to make data-driven decisions, identify bottlenecks, and optimise workflows.

Recommended tools for comprehensive O2C analytics include SAP Analytics Cloud, Tableau, and Power BI. These platforms offer advanced features for visualising data, monitoring key performance indicators (KPIs), and generating actionable insights.

Example: General Electric (GE) uses Tableau to analyse their O2C data, enabling them to streamline operations and improve collection rates. The real-time insights provided by Tableau have allowed GE to reduce days sales outstanding (DSO) and enhance overall financial performance.

Robotic Process Automation (RPA) and intelligent process automation are revolutionising O2C processes by automating repetitive tasks such as invoicing, payment processing, and collections. These technologies not only increase efficiency but also reduce errors and operational costs.

Many companies are deploying Intelligent Process Automation solutions, an advanced form of Business Process Automation (BPA), to manage routine, rule-based functions such as accounts payable invoice processing and sales order processing. By performing these tasks in-house, companies can ensure the security of corporate and client data. Additionally, it establishes a credible audit trail for company records, aiding in regulatory compliance.

Benefits: Automating invoicing ensures that invoices are generated and sent promptly, improving cash flow. Automated payment processing speeds up transactions, while automated collections reduce the time and effort required to follow up on overdue payments.

Example: Siemens implemented RPA in their O2C processes, resulting in a 30% reduction in manual processing time and a significant decrease in errors. This automation has enabled Siemens to focus more on strategic tasks and improve overall financial efficiency.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming O2C processes by enabling predictive analytics and assessing customer creditworthiness. AI-driven tools can analyse vast amounts of data to predict payment behaviors, identify potential risks, and optimise credit management.

Real-world example: IBM leverages AI in their O2C operations to predict customer payment patterns and assess credit risk. By using AI-driven insights, IBM has improved their cash flow forecasting and reduced bad debt write-offs, enhancing overall financial stability.

By leveraging technology in the Order to Cash (O2C) process, businesses can significantly boost efficiency and productivity. Automation reduces manual intervention, which speeds up processing times and minimises errors. This streamlined approach ensures that orders are processed swiftly and accurately, leading to faster revenue recognition and improved operational performance.

Technology-driven O2C outsourcing provides real-time visibility into accounts receivable and cash flow status. This improved transparency allows businesses to better predict and manage cash inflows, ensuring that they have the liquidity needed to meet their obligations and invest in growth opportunities.

A seamless and efficient O2C process directly contributes to a better customer experience. Faster query resolution and effective dispute management are crucial in maintaining customer satisfaction. Technology enables quicker responses to customer inquiries and issues, fostering a positive relationship and enhancing customer loyalty.

One of the most significant benefits of technology-driven O2C outsourcing is cost savings. Automation reduces the need for manual labor, which lowers operational costs. Additionally, outsourcing the O2C function allows businesses to benefit from the expertise and economies of scale of their outsourcing partners, leading to further cost reductions.

By outsourcing the O2C process, companies can free up internal resources that can be better utilised in core business activities. This allows businesses to focus on strategic initiatives and growth, rather than being bogged down by administrative tasks.

Technology-driven O2C solutions provide real-time data and analytics, which are invaluable for strategic planning and decision-making. Businesses can gain insights into customer behavior, payment patterns, and financial performance, enabling them to make informed decisions that drive growth and profitability.

Discover how QX helped a leading recruitment giant optimise their O2C process through bank download automation. Read our case study for in-depth insights!

Harnessing technology in Order to Cash outsourcing offers transformative potential for businesses looking to streamline their financial operations. Recent studies conducted by Infosys BPM indicate that O2C automation can increase sales revenue by 1% to 3% and cut operational costs by as much as 30%.

The strategic benefits, such as improved cash flow management, enhanced accuracy, and faster processing times, make it an essential consideration for modern enterprises. Practical advice for businesses includes investing in the right technology, choosing experienced outsourcing partners, and continuously monitoring and optimising processes to maintain a competitive edge.

QX Global Group stands at the forefront of technology-driven order to cash outsourcing servces, providing advanced solutions that cater to the unique needs of businesses across various industries. Our expertise in leveraging cutting-edge technologies ensures that your O2C processes are not only efficient but also future proof. From automated invoicing to real-time analytics, our comprehensive suite of services is designed to enhance your financial performance and drive growth.

Contact us today to discover how we can help transform your financial operations and achieve your strategic objectives.

The Order-to-Cash (OTC) collection cycle starts with receiving a customer order and ends with payment collection. Key steps include order management, credit management, order fulfillment, invoicing, payment collection, and accounts receivable management. Efficient OTC management is crucial for maintaining cash flow and ensuring timely revenue realisation. Order to cash outsourcing services involves hiring third-party providers for specific functions like accounting or IT support. An in-house team consists of company employees performing these functions. Outsourcing can save costs, provide specialised expertise, and offer scalability. An in-house team offers greater control, direct communication, and alignment with company culture. Collaboration outsourcing is when an organisation partners with an external provider to co-manage business processes. Unlike traditional outsourcing, it focuses on joint efforts, shared responsibilities, and close coordination to achieve common goals and optimise performance. FAQs

What is the OTC collection cycle?

What is the difference between O2C services outsourcing and in-house team?

What is collaboration outsourcing?

Originally published Jul 02, 2024 08:07:24, updated Mar 28 2025

Topics: Finance and Accounting Outsourcing Services, Order-to-cash cycle