Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation

F&A Process Outsourcing: How to Make it Work?

Posted on July 01, 2024

Written By Priyanka Rout

Let’s begin with an insightful stat: The global market for finance and accounting business process outsourcing was valued at $56.42 billion in 2022. It is expected to grow at a rate of 9.1% per year from 2023 to 2030.

F&A process outsourcing has become a powerful tool for financial leaders aiming for success. Efficiency and agility have become essential for businesses aiming to stand out and deliver the best in the shortest time possible.

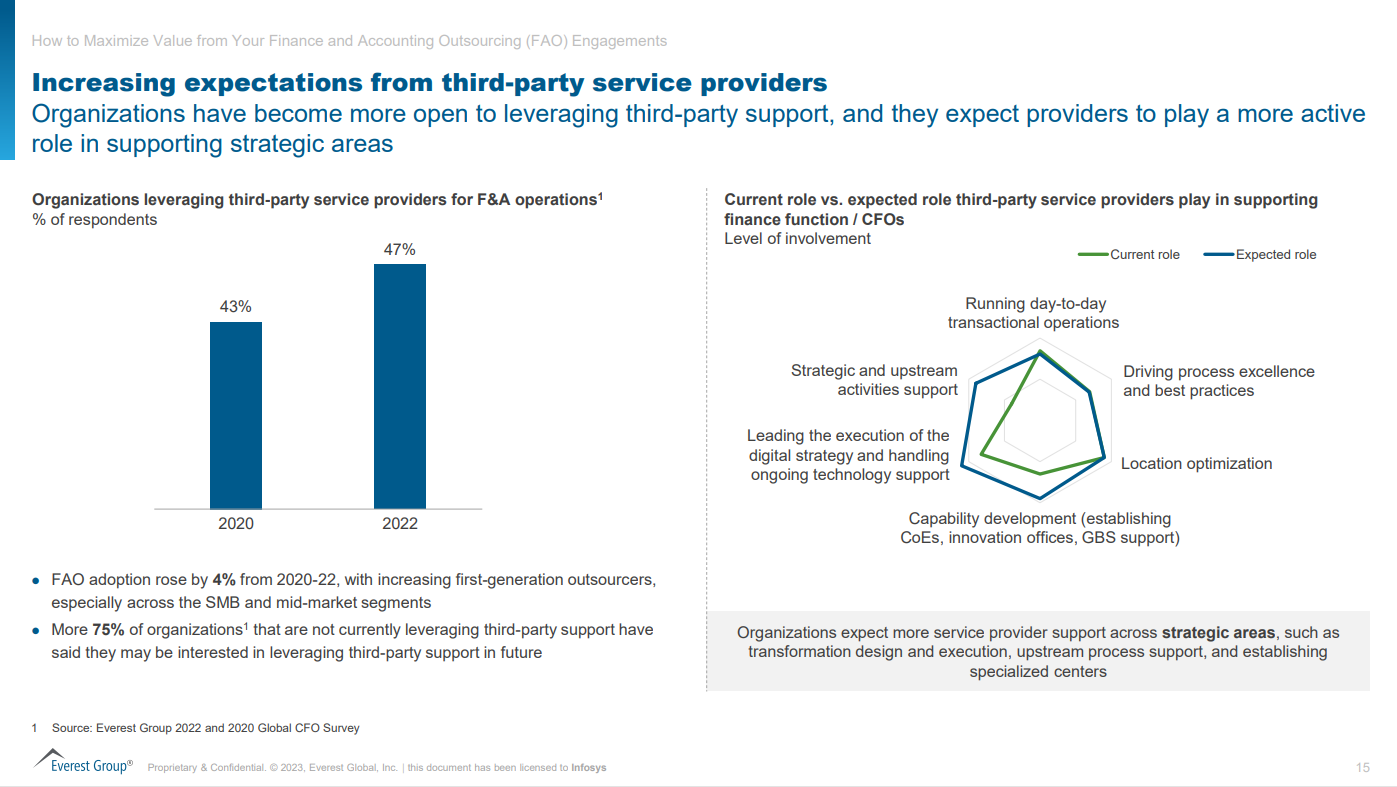

Increasing expectations from third-party service providers; Source: InfosysBPM

Firms now look for finance and accounting outsourcing service companies who offer expertise, scalability, and access to advanced technologies like AI and machine learning. This shift goes beyond cost-cutting; it’s about leveraging specialised skills and innovative solutions to remain competitive. For many businesses, finance and accounting outsourcing represents the fine line between mere survival and true success.

Keeping up with the latest trends and best practices in F&A process outsourcing is crucial. This blog explores critical aspects of outsourcing, including ensuring quality, fostering effective communication, and implementing strategies for success. Whether you’re new to outsourcing or looking to optimise your current approach, this guide provides valuable insights to master finance and accounting outsourcing with key strategies, best practices, and tips.

Ensuring Quality in F&A Process Outsourcing

- Integrating Advanced Analytics and AI: Leveraging cutting-edge technologies like artificial intelligence (AI) and advanced analytics can transform F&A processes. These technologies enable predictive analytics for better financial decision-making, automate routine tasks to reduce errors, and ensure consistent quality in financial reporting. This approach not only enhances accuracy but also provides strategic insights that help companies stay competitive.

- Adopting Robotic Process Automation (RPA): RPA can significantly improve the efficiency and accuracy of F&A processes by automating repetitive tasks such as data entry, reconciliations, and report generation. This not only speeds up processes but also frees up human resources for more complex and value-added activities, ensuring a higher quality of service and reducing the likelihood of human error.

- Implementing Continuous Improvement Frameworks: Utilizing frameworks like Six Sigma and Lean within F&A process outsourcing can lead to continuous quality and efficiency improvements. These methodologies focus on minimizing waste and reducing variability in processes, which enhances the overall service quality delivered to clients.

- Ensuring Compliance and Regulatory Adherence: In the ever-changing landscape of financial regulations, ensuring compliance is critical. Outsourcing partners should not only stay updated with current financial regulations but also anticipate changes. This proactive compliance helps prevent legal issues and maintains the integrity of financial data.

- Fostering a Culture of Quality and Excellence: Creating a culture that emphasizes quality and continuous improvement in the outsourced team can significantly impact the outcomes. Regular training sessions, clear communication of quality standards, and recognition of high-quality work encourage a commitment to excellence across the team.

- Leveraging Cloud Technology for Collaboration and Security: Utilizing cloud-based platforms enables real-time collaboration, seamless data integration, and enhanced security protocols. This ensures that financial data is not only up-to-date and accessible but also secure from cyber threats, which is crucial in maintaining the trust and reliability of F&A services.

- Strategic Partner Management and Alignment: Selecting the right outsourcing partner and maintaining a strategic relationship is key. This involves regular performance reviews, alignment on goals and expectations, and open communication channels. Such alignment ensures that the outsourcing partner is not just a service provider but a strategic ally that contributes to the business’s success.

Fostering Effective Communication in F&A Partnerships

- Create Communication Guidelines: It might seem unnecessary since everyone can read, write, and speak, but refining these basics is crucial. Decide on a common business language, such as English, and ensure everyone uses it consistently. This ensures clear and inclusive communication.

- Define Communication Channels: Make sure all team members know which communication tools to use. Using the wrong channel might result in lost messages and important information. Select reliable tools for communication and collaboration and stick to them throughout the project to maintain consistent and effective feedback loops.

- Set Clear Expectations: Clearly outline what you expect from your outsourcing partner. Provide specific details on project timelines, deliverables, and measurable key performance indicators. This ensures everyone knows what to aim for.

- Limit One-on-One Communication: Although it might seem strange, avoid one-on-one communication to prevent isolating team members. Important information should be shared with the whole team to ensure transparency and avoid any critical details being missed.

- Respect Cultural Diversity: Cultural differences can impact team communication and integration. Be mindful of varying customs, such as dietary restrictions or social norms, to avoid misunderstandings. Respect cultural practices and time zone differences to foster a positive and cohesive team environment.

- Regular Progress Updates: Hold regular meetings to update everyone on project progress. Celebrating small milestones can boost team morale and make large tasks seem more achievable.

- Use Cloud File Sharing: Share files via the cloud to improve efficiency. This eliminates the need to wait for someone to send files, making important information easily accessible to all team members and saving valuable time.

- Keep the Team Motivated: Remember that behind every communication tool is a person. Regularly check in with the outsourced team on a personal level, showing interest in their well-being and motivations. This helps create a positive work environment where team members feel respected and valued.

Strategies for Effective F&A Process Outsourcing

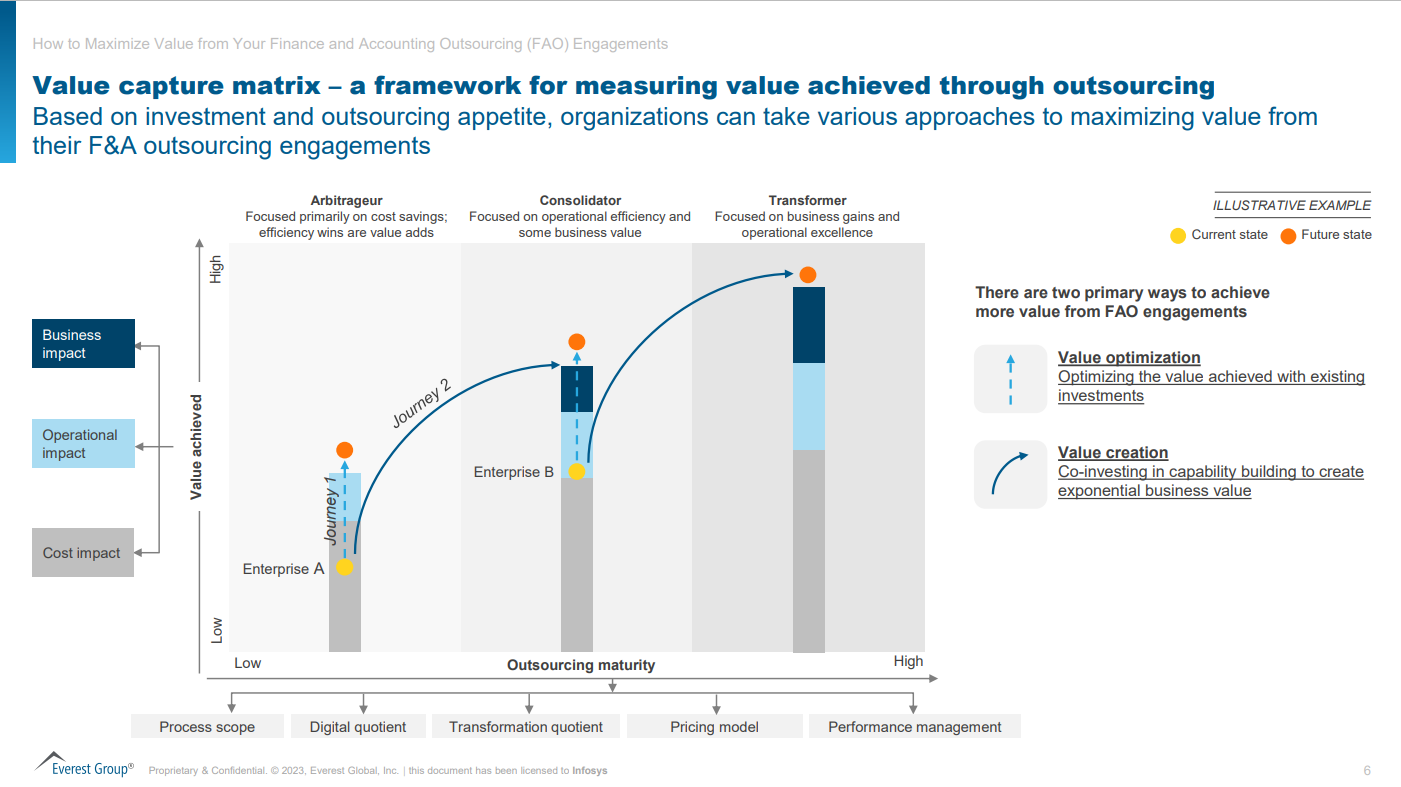

Value Capture Matrix – a framework for measuring value achieved through outsourcing; Source: InfosysBPM

- People: The success of F&A process outsourcing significantly depends on the people involved. Investing in skilled professionals who are not only experts in finance but also in specific industries can lead to better insights and more tailored financial strategies. Additionally, ensuring that the outsourced team aligns with the company’s culture and values fosters a more cohesive working relationship. This includes regular training in technical skills and company-specific processes, and initiatives to integrate outsourced staff into the company’s culture through team-building activities and communications.

- Process: Streamlining and optimizing processes are crucial in outsourcing. Implementing process improvements like Lean and Six Sigma can minimize waste and reduce errors. Further, automation through Robotic Process Automation (RPA) transforms tedious, repetitive tasks into automated processes, enhancing efficiency and accuracy. This shift not only speeds up the financial operations but also allows the human workforce to focus on higher-value tasks like analysis and decision support.

- Platform: Utilizing a unified technology platform that integrates various financial functions—such as payables, receivables, payroll, and reporting—can lead to better data accuracy and easier access to information. Modern platforms often include cloud-based systems that offer real-time data processing and enhanced security features, ensuring that financial data is both accessible and secure. This integration supports better decision-making and more efficient operations.

- Data-Driven Decision Making: Harness the power of big data analytics to gain actionable insights and forecast trends. Outsourcing partners equipped with advanced data analytics tools can provide deeper insights into financial health, operational efficiency, and market opportunities. This data-driven approach enables businesses to make informed strategic decisions quickly.

- Strategic Partner Management: Develop a relationship with your outsourcing provider that goes beyond the transactional. Treat them as strategic partners involved in the business’s growth. This involves setting clear expectations, sharing long-term goals, and working collaboratively on innovation. Regular reviews and feedback sessions ensure that both parties are aligned and can adapt to changing business needs effectively.

- Regulatory Compliance and Risk Management: Stay ahead of the regulatory curve by ensuring your outsourcing partner has a robust compliance and risk management framework. This includes regular updates and training on the latest financial regulations, ethical guidelines, and security protocols to mitigate risks associated with financial reporting and ensure compliance with international standards.

- Scalability and Flexibility: Choose an outsourcing solution that offers scalability and flexibility to handle fluctuating volumes of financial transactions without compromising on quality or efficiency. This allows your business to adapt to market conditions and growth opportunities without the need for extensive internal infrastructure changes.

RELATED BLOG: Essential Finance and Accounting Outsourcing Questions Answered

What’s the Bottom Line?

Quality, communication, and strategic planning are paramount in F&A outsourcing services. These elements ensure not only the smooth operation of your financial processes but also drive the overall success and growth of your business. Staying updated with the latest F&A outsourcing trends and innovations is equally critical, as it allows your organisation to remain competitive and efficient.

At QX Global Group, we integrate these essential aspects into our financial services outsourcing, ensuring that our clients receive top-notch solutions tailored to their unique needs. Our commitment to excellence and innovation sets us apart, providing you with the assurance that your financial operations are in expert hands.

Finance and accounting outsourcing involves hiring external service providers to manage financial functions such as accounts payable, accounts receivable, payroll, and bookkeeping, allowing businesses to focus on core operations and strategic growth. A key financial benefit of outsourcing is cost reduction. Businesses can save on labor and operational costs, including expenses related to hiring, training, and maintaining an in-house finance team.FAQs

What is finance and accounting outsourcing?

What is a financial benefit of outsourcing?

What are 3 advantages of outsourcing?

Originally published Jul 01, 2024 05:07:55, updated Oct 04 2024

Topics: Finance and Accounting Outsourcing Services, Finance and Accounting Transformation