Topics: Finance & Accounting Outsourcing

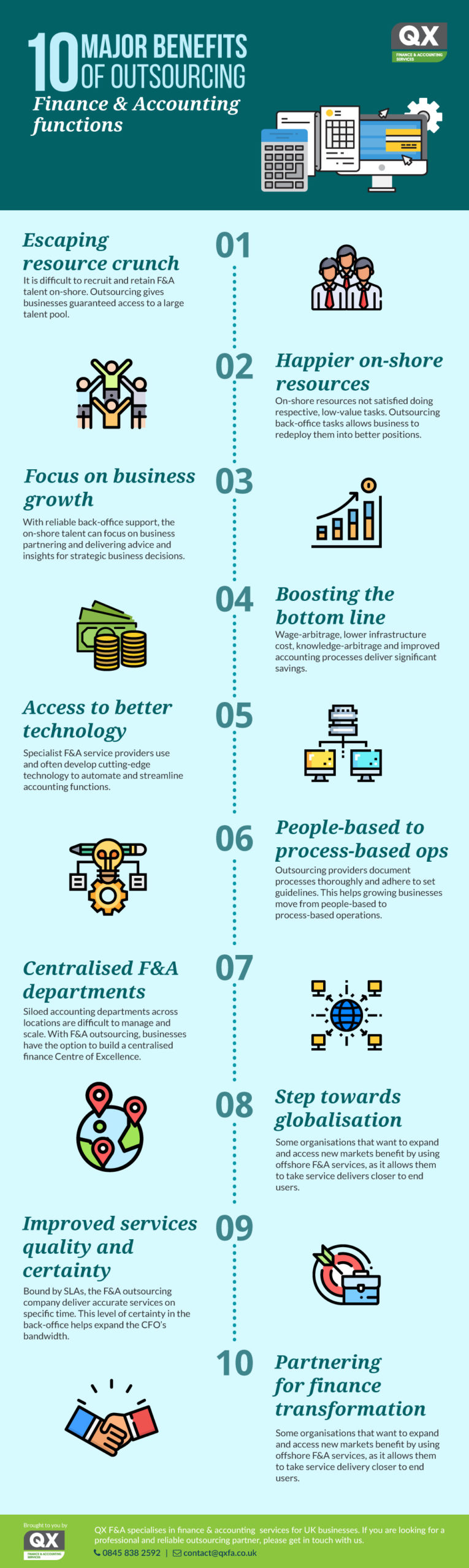

10 major benefits of outsourcing Finance & Accounting functions

Posted on September 14, 2018

Written By QX Global Group

Why do businesses in the UK and EU outsource finance & accounting functions? Is it just for the cost savings, or do they look for something more than that? This infographic takes a closer look at benefits that organisations expect from F&A services outsourcing.

1. Escaping resource crunch

It is difficult to recruit and retain F&A talent on-shore. Outsourcing gives businesses guaranteed access to a large talent pool.

2. Happier on-shore resources

On-shore resources not satisfied doing respective, low-value tasks. Outsourcing back-office tasks allows business to redeploy them into better positions.

3. Focus on business growth

With reliable back-office support, the on-shore talent can focus on business partnering and delivering advice and insights for strategic business decisions.

4. Boosting the bottom line

Wage-arbitrage, lower infrastructure cost, knowledge-arbitrage and improved accounting processes deliver significant savings.

5. Access to better technology

Specialist F&A service providers use and often develop cutting-edge technology to automate and streamline accounting functions.

6. People-based to process-based ops

Outsourcing providers document processes thoroughly and adhere to set guidelines. This helps growing business move from people-based to process-based operations.

7. Centralised F&A departments

Siloed accounting departments across locations are difficult to manage and scale. With F&A outsourcing, businesses have the option to build a finance Centre of Excellence.

8. Step towards globalisation

Some organisations that want to expand and access new markets benefit by using offshore F&A services, as it allows them to take service delivery closer to end users.

9. Improved services quality and certainty

Bound by SLAs, the F&A outsourcing company deliver accurate services on specific time. This level of certainty in the back-office helps expand the CFO’s bandwidth.

10. Partnering for finance transformation

CEOs and CFOs seeking finance transformation do not have the resources or bandwidth for a major F&A transformation initiative. Partnering with an offshore partner solves this problem.

Originally published Sep 14, 2018 12:09:01, updated Jul 23 2024

Topics: Finance & Accounting Outsourcing