Topics:

Post-Brexit: A Look at Upcoming Payroll Trends in 2020

Posted on February 06, 2020

Written By QX Global Group

– Winston Churchill, 1942

The year 2020 will always be etched into the history of Britain as both the year of bidding farewells and new beginnings. Now that UK has formally left the European Union, it immediately enters an 11-month transition period where most things from the color of the British passport to amendments in payroll and employment laws will carry out during the year 2020.

For accountants, it’s a double whammy – the payroll year-end is already on the doorsteps; while the implications of Brexit simultaneously unfold. However, at some point, every accountant has a duty to bring as much certainty as possible to ensure the protection and prosperity of their practices and their clients – through their financial forecasting and guidance.

So, here’s a lowdown on all the anticipated changes in payroll legislations that will be coming into effect on April 6, 2020 to help accountants carve the right financial roadmap for their clients during this Brexit transition period:

- More Companies will jump on the Auto-Enrolment Band-wagon

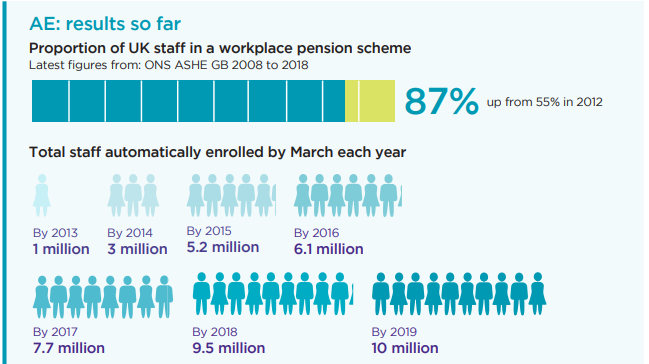

Like MTD, Blockchain and all things digital in accounting – Auto-Enrollment is also making way into the good books of many business. There was a significant spike in the number of eligible staff participating in workplace pension schemes. By February 2019, 10 million workers had been auto-enrolled and fewer than 10% of those eligible had opted out. A major victory for The Pension Regulator who started at just a million of the UK staff members in 2013.

Source: The Pension Regulator

Ever since its establishment in 2013, the government had devised ways to get more people into auto-enrolment through a lot of ‘budge’ economic tactics, including lowering the qualifying age to 18, starting contributions from the first £1 earned and bringing the self-employed into auto-enrolment. The patterns point to a potential significant rise in the number of small to medium businesses to opt for PAE in 2020 – riding the digital wave in accounting.

- Employment Allowance (EA) might fluctuate

The government announced that from 6 April 2020, employers will only be eligible for the EA if their total secondary Class 1 liability in the previous tax year was under £100,000. According to Kate Upcraft’s AccountingWeb piece, small businesses who are eligible to claim the EA will have to further answer numerous additional questions on the Employment Payment Summary (EPS).

It is clear from the amendments that the government is tightening its grip on availing the allowance and why the legislations now demand for the claimants to have sufficient headroom in their de minimis state aid threshold over the two preceding years from the year of claim. The new exchange states for calculating the de minimis state aids in March will be published here.

Why only small businesses?

Established in 2014, the idea behind the allowance was to encourage and support small businesses to grow in strength and hire new staff. With the rate of allowance staying still at £3,000 annually, the government realised it wouldn’t be of much interest to larger businesses and wouldn’t pose as an incentive to them.

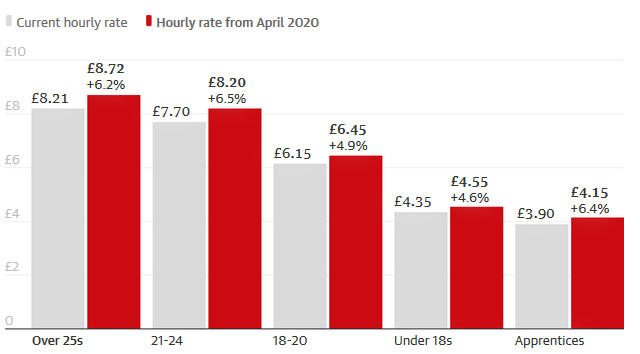

- A Spike in the Minimum Wage

On December 31, 2019, the government announced that the “national living wage” for over 25s would increase from £8.21 an hour to £8.72 from April 2020. Being four times higher than the rate of inflation in the UK, the spike in the minimum wage instills trust in the government against the backdrop of the heightened uncertainty over Brexit and slowdown in the world economy. The increase in national wage is a trend that is here to stay. In fact, the Labor government anticipated the net earnings of an individual to rise by £1,900 over five years.

Here’s a breakdown of the wage raise across all age groups:

- A 6.5% increase from £7.70 to £8.20 for 21-24-year-olds

- A 4.9% increase from £6.15 to £6.45 for 18-20-year-olds

- A 4.6% increase from £4.35 to £4.55 for Under-18s

- A 6.4% increase from £3.90 to £4.15 for Apprentice

Source: HM Treasury

- Holiday Pay and Other Employment Laws

Holiday pay has been a subject of massive debate for decades before the EU stepped in with an agreeable conclusion to put an end to the rift in 1998.

For over 20 years, EU’s work time regulations bought holidays for over six million workers. But with the advent of Brexit, holidays pay is under threat again with the government scrutinising whether the current reference period of evaluating 12 weeks prior to the leave, fairly reflects the average pay of the worker.

Hence with Brexit, comes a new change in the legislation: the reference period for calculating holiday pay will be extended to 52 weeks of employment. The intention behind this change is to get a broader picture of an employee’s attendance and a reflection of average pay as the fluctuations in work and pay occur throughout the year.

IR35 and the Future of Contractors:

With the looming threat of IR35, there seems to be a rising trend of private employers who are reluctant to bring the contractors on payroll. It is anticipated that the new off working payroll rules will only affect medium and large private sector organizations, so small businesses are set to exempt from it.

Under current legislation this is broadly a business that has two or more of the following features:

- a turnover of more than £10.2m

- a balance sheet total of more than £5.1m

- 50 employees or more

Keeping in mind the client’s business size – for accountants, this would be the right time to alert your clients about taking pre-emptive steps on determining employee status; restructuring payroll processes and controls; considering contractual agreements with their employees etc.

On April 6, 2020 the IR35 law will be officially implemented onto the private sector.

The Takeaway for Accountants

A recent New York Times’ opinion piece succinctly summed up the current reality of the Brexit situation in their title: “Brexit is Here! Sort of.”

Even though Britain has officially withdrawn from the UK – wrangling about trade and economic ties between Britain and the EU are yet to reach a consensus and the same can be said about Britain’s own internal law reforms. Accountancy, as a profession, has narrowly escaped from any direct consequences of Brexit, unlike trade or business; but the same cannot be said for the end clients of accounting firms.

There is much to be said about all that’s not in our hands in this Post-Brexit Britain. But for accountants, it’s often natural; rather instinctive to forecast for success by staying on top of emerging trends, legislations, and do what we can to instill a sense of certainty for their firms and clients.

Originally published Feb 06, 2020 12:02:03, updated Mar 10 2022

Topics: