Topics: Accounts Receivable Process, Senior Living

The Role of Technology in Streamlining Accounts Receivable Processes in Senior Living

Posted on December 24, 2024

Written By Chithrakala Babu

How much time does your finance team spend chasing overdue payments, reconciling accounts, and fixing manual invoicing errors? If you’re like most senior living communities, it’s likely far too much—time that could be spent on strategic initiatives or enhancing resident care. What if there was a way to transform your accounts receivable (AR) process into a streamlined, error-free system that saves time, cuts costs, and boosts operational efficiency?

As the industry grapples with rising operational costs, regulatory pressures, and growing resident expectations, technology emerges as a powerful ally. From automation to predictive analytics, leveraging advanced AR technologies can streamline operations, enhance efficiency, and enable organizations to reinvest resources where they matter most—delivering exceptional care.

In this blog, we’ll discuss exactly that—the challenges of manual AR processes, the technologies redefining AR, and practical strategies for finance leaders to drive digital transformation.

The Challenges of Manual AR Processes in Senior Living

Finance leaders in senior living facilities face a range of AR-related challenges that are amplified by manual workflows:

- Delayed Payments and Errors: Manual invoice processing is prone to delays and errors. Finance leaders identify inefficient invoice handling as a top AR challenge, leading to late payments and cash flow inconsistencies.

- Data Silos and Limited Visibility: Decentralized operations across multiple locations often result in fragmented data, making it difficult for finance teams to track payment statuses or generate real-time insights.

- Compliance Challenges: Senior living communities must navigate stringent regulatory requirements like SOC 1 and HIPAA compliance. Manual processes increase the risk of non-compliance, inviting audits and penalties.

- Scalability Issues: As facilities grow, managing increasing payment volumes with manual methods becomes unsustainable, leading to bottlenecks and inefficiencies.

- Rising Labor Costs and Talent Shortages: Finance teams often spend excessive time on repetitive tasks like data entry and reconciliation, further strained by the challenges of hiring and retaining skilled professionals.

How Technology Addresses AR Challenges

Technology offers a transformative solution to the above challenges, enabling finance leaders to create streamlined, accurate, and scalable AR processes. Here’s how:

1. Automation for Faster Processing

Automation tools like robotic process automation (RPA) can eliminate manual data entry by automating invoice capture, processing, and reconciliation. For example, QX ProAR’s OCR engine extracts data from bulk remittance advices in real time, reducing errors and increasing processing speed.

2. Predictive Analytics for Cash Flow Forecasting

AI-driven predictive analytics tools analyze historical payment patterns to forecast future cash inflows. This enables organizations to identify potential delays early and take proactive measures to maintain healthy cash flow. According to McKinsey, applying AI-driven forecasting to businesses processes can reduce errors by 20%-50%.

3. Cloud-Based Centralization

Cloud AR platforms centralize operations, providing a unified view of payment statuses across all facilities. This is particularly beneficial for multi-location senior living organizations, enabling real-time data access and collaboration.

4. Real-Time Dashboards and Reporting

Advanced dashboards provide insights into key metrics such as Days Sales Outstanding (DSO), overdue payments, and vendor performance. These actionable insights empower finance teams to identify bottlenecks and optimize workflows.

5. Enhanced Security and Compliance

Digital tools ensure compliance with industry regulations like SOC and HIPAA by maintaining secure, auditable records of financial transactions. QX ProAR, for example, integrates end-to-end compliance measures, reducing the risk of regulatory violations.

Key Strategies for Leveraging AR Technology

Adopting AR technology requires more than just investing in software—it demands a strategic approach that aligns tools with organizational goals. Here are actionable strategies:

1. Conduct a Comprehensive AR Audit

Before implementing new technologies, conduct a detailed review of your current AR processes. Identify inefficiencies, such as delayed payments or high error rates, and map out areas where automation can deliver maximum impact.

2. Pilot Technology in High-Impact Areas

Rather than overhauling the entire AR system at once, start with a pilot program targeting the most error-prone or time-consuming tasks, such as invoice processing or reconciliation. For instance, begin by automating payment reminders for overdue invoices, which can significantly improve collection rates while reducing manual follow-ups.

3. Invest in Scalable Cloud Solutions

Select cloud-based tools that can adapt as your community grows. Look for features like bulk data processing, customizable templates, and seamless integration with existing systems. Choose AR software that supports multiple payment methods and integrates with your facility’s financial management system to ensure smooth operations as the number of residents grows.

4. Train and Upskill Finance Teams

Introducing AR technology is only effective if your team can leverage it fully. Offer regular training sessions to help staff understand the new tools and maximize their potential. With the right technology partner, the knowledge transfer and mobilization will be faster and impactful with minimal support from your side.

5. Partner with a Finance Transformation Expert

Collaborating with an experienced finance transformation partner can accelerate your digitization journey. The journey will be even better if they have niche expertise, to ensure seamless support and 100% results. These partners not only provide access to cutting-edge tools but also offer the expertise needed to implement them effectively.

Introducing QX ProAR: Your Partner in AR Automation

QX Global Group’s ProAR tool is designed to address the unique challenges of AR management in senior living. Here’s how QX ProAR can revolutionize your AR processes:

- Automated Data Capture: QX ProAR’s OCR engine processes remittance advices and invoices in real time, eliminating manual data entry errors.

- Bulk Processing: Handle high volumes of data seamlessly, improving efficiency and scalability.

- Insightful Reporting: QX ProAR generates customizable dashboards, providing finance leaders with actionable insights to optimize cash flow management.

- Real-Time Processing: With 24/7 automation capabilities, QX ProAR ensures timely processing of payments, enhancing vendor relationships.

- Compliance and Security: QX ProAR adheres to SOC and other industry standards, ensuring complete regulatory compliance.

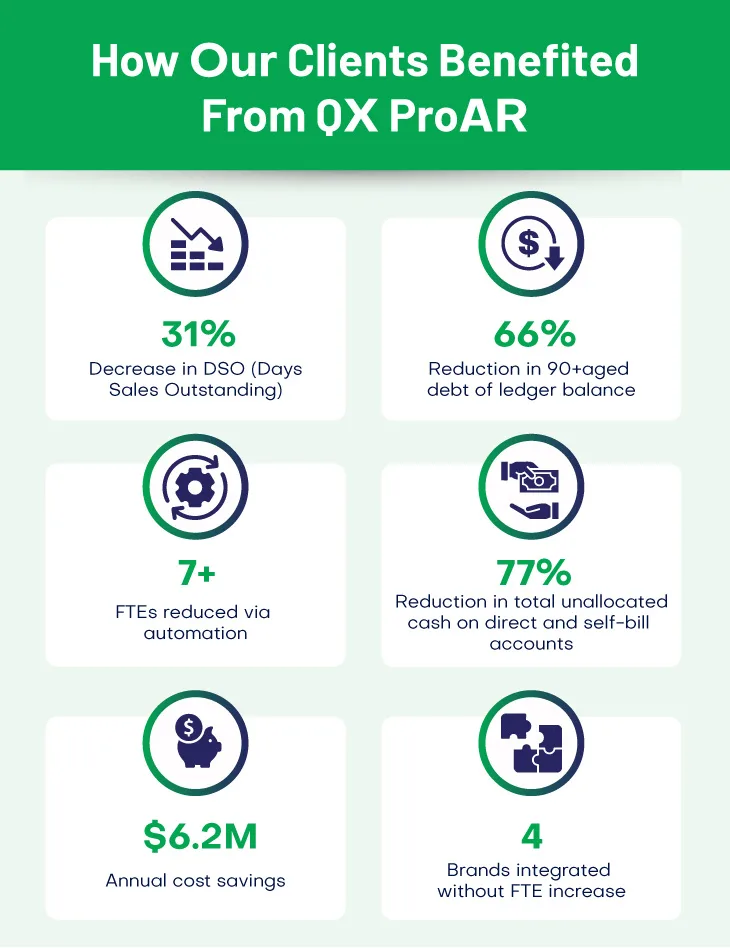

Let’s take a look at some of the benefits delivered to our clients using QX ProAR.

The Benefits of Digitized AR Processes in Senior Living

By leveraging AR automation tools like QX ProAR, senior living communities can unlock a host of benefits:

- Faster Payment Cycles: Automated workflows ensure timely invoice processing and reconciliation.

- Reduced Costs: By minimizing manual errors and labor-intensive tasks, organizations can achieve significant cost savings.

- Improved Cash Flow Visibility: Real-time insights enable finance leaders to manage cash flow proactively.

- Enhanced Scalability: Automated systems grow with your organization, handling increased transaction volumes effortlessly.

- Regulatory Confidence: Ensure compliance with industry standards, reducing audit risks.

Conclusion

The senior living industry stands at the crossroads of financial complexity and technological opportunity. By embracing AR digital transformation, finance leaders can not only streamline their processes but also create a sustainable financial future for their organizations.

Partnering with QX Global Group and leveraging tools like QX ProAR can accelerate this transformation, enabling your senior living facility to focus on its core mission: delivering exceptional care to residents.

Ready to take the first step? Let’s discuss how QX can help you transform your AR processes.

Originally published Dec 24, 2024 11:12:14, updated Jan 23 2025

Topics: Accounts Receivable Process, Senior Living