Topics: Finance and Accounting Outsourcing Services, Hospitality Accounting

Finance Digital Transformation in Hospitality: A Guide for 2025

Posted on December 18, 2024

Written By Chithrakala Babu

2025 is poised to be a pivotal year for finance transformation in hospitality, with trends like automation, predictive analytics, and cloud-based solutions leading the charge. These advancements aren’t just about improving efficiency—they’re about reimagining how finance teams operate in a dynamic industry.

But while the promise of digital transformation is enticing, many organizations face barriers like limited resources, data silos, and resistance to change. How can finance leaders overcome these challenges to unlock the full potential of technology and deliver value across their operations?

In this blog, we’ll dive into the key challenges, emerging trends, and strategies that finance leaders in hospitality can implement in 2025 to drive digital transformation and stay ahead.

Challenges Faced by Finance & Accounting Teams in Hospitality

The lack of digitization creates bottlenecks and inefficiencies in finance & accounting operations, leaving teams struggling to keep up with the demands of a dynamic industry. Here are some common challenges:

- Manual Data Entry: Tedious and error-prone, manual tasks delay critical processes like invoicing, reconciliation, and reporting.

- Fragmented Systems: Disparate tools across departments create silos, making it difficult to consolidate and analyze financial data effectively.

- Slow Decision-Making: Without real-time insights, finance leaders struggle to respond swiftly to market shifts and operational needs.

- Cash Flow Visibility: Inconsistent tracking and reporting lead to missed opportunities, such as early payment discounts or strategic investments.

- Compliance Risks: Regulatory complexities increase the risk of non-compliance when processes are managed manually.

- Talent Shortages: High turnover and limited access to skilled finance professionals exacerbate inefficiencies in managing financial operations.

Benefits of Finance Digital Transformation

Embracing digital transformation can turn these challenges into opportunities for growth and innovation. Key benefits include:

- Increased Efficiency: Automating routine tasks like accounts payable (AP) and accounts receivable (AR) frees up time for strategic initiatives.

- Enhanced Accuracy: AI-driven tools minimize human errors, ensuring accurate financial records and reporting.

- Improved Cash Flow: Real-time monitoring and predictive analytics optimize cash flow management, enhancing liquidity and operational flexibility.

- Stronger Compliance: Digital tools simplify regulatory reporting and mitigate risks associated with audits or legal scrutiny.

- Data-Driven Decision-Making: Centralized platforms provide actionable insights, enabling leaders to make informed decisions faster.

- Cost Savings: Automation reduces the need for additional manpower and cuts overhead costs, improving margins.

Digital Trends Shaping Finance Transformation in Hospitality

Finance leaders must stay ahead of emerging trends to build future-ready operations. Here are the technologies reshaping the landscape:

- Artificial Intelligence (AI): AI-powered tools analyze large volumes of financial data to identify patterns, predict trends, and optimize decision-making.

- Robotic Process Automation (RPA): Automates repetitive tasks like invoice processing, payroll management, and reconciliations, boosting efficiency.

- Blockchain Technology: Ensures secure, transparent, and tamper-proof financial transactions, particularly useful in vendor management and cross-border payments.

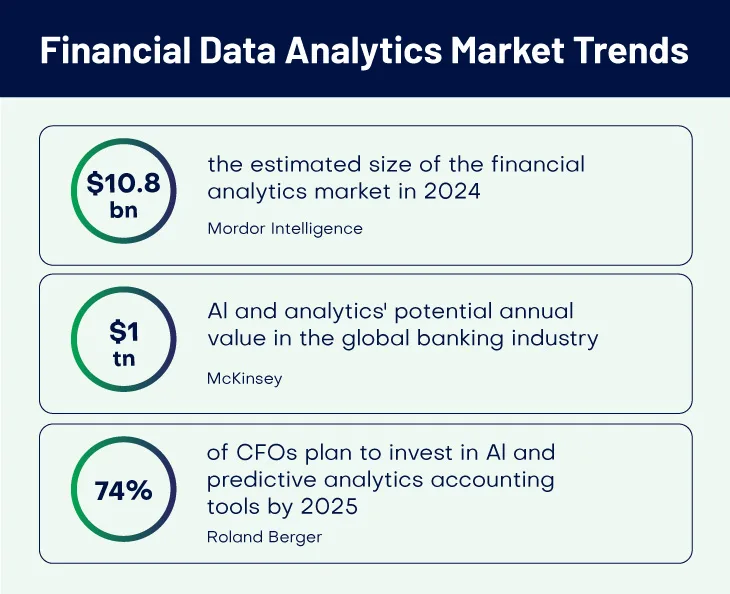

- Predictive Analytics: Forecasting tools provide actionable insights for budgeting, staffing, and revenue management.

- Cloud-Based Solutions: Enable seamless data sharing and collaboration across departments and geographies, ensuring scalability.

- Integrated ERP Systems: Streamline end-to-end finance operations by connecting all financial processes on a single platform.

Strategies for Finance Digital Transformation in Hospitality

Finance digital transformation requires more than just adopting new tools—it demands a strategic mindset, a clear roadmap, and a focus on creating value across the organization. Here’s how hospitality finance leaders can implement impactful strategies to digitize their operations effectively in 2025.

1) Embrace Advanced Automation

Automation is the cornerstone of finance digitization. By automating repetitive and time-consuming tasks like accounts payable (AP), accounts receivable (AR), and reconciliation processes, hospitality businesses can achieve significant efficiency gains.

- Implement RPA and AI: Use Robotic Process Automation (RPA) to handle high-volume, repetitive tasks, and AI-powered tools to analyze complex data sets, detect anomalies, and predict trends.

- Benefits: Reduced processing times, minimized errors, and reallocation of resources to high-value activities such as budgeting and forecasting.

2) Leverage Data Analytics for Real-Time Insights

Data analytics transforms raw financial data into actionable insights. With real-time analytics, finance teams can monitor key performance indicators (KPIs), assess profitability, and forecast cash flow more accurately.

- Focus Areas: Revenue forecasting, operational cost analysis, and customer behavior tracking.

- Tools to Consider: Business intelligence platforms and predictive analytics software.

3) Invest in Cloud-Based Financial Systems

Cloud-based platforms provide a scalable, flexible foundation for finance operations. These systems centralize financial data, ensuring seamless collaboration and easy access to real-time information.

- Advantages: Reduced IT overhead, improved data integration, and enhanced scalability for growing operations.

- Applications: Enterprise Resource Planning (ERP) systems and cloud-native accounting software.

- Benefits: Faster decision-making and streamlined multi-location financial operations.

4) Enhance Cybersecurity Measures

As digitization grows, so do the risks associated with cyber threats. Safeguarding financial data and ensuring compliance with US-specific regulations like the Payment Card Industry Data Security Standard (PCI DSS) and SOC (System and Organization Controls) frameworks is non-negotiable. These standards help finance leaders maintain trust, ensure data integrity, and mitigate risks in an increasingly digital landscape.

- Best Practices: Regularly update software, use multi-factor authentication (MFA), and conduct periodic security audits.

- Emerging Technologies: Blockchain for secure transactions and AI for threat detection.

5) Foster a Culture of Continuous Learning

Technology is only as effective as the people using it. Investing in ongoing training ensures that finance teams stay ahead of the curve, adapting to new tools and methodologies. Provide your team with access to certification programs, workshops, and cross-departmental training initiatives. Consider areas such as data literacy, AI adoption, and automation tools in the initial phase.

6) Partner with a Finance Transformation Expert

Digitization in hospitality finance thrives on strategic collaboration. Partnering with a finance transformation expert can combine outsourcing efficiency with cutting-edge technology implementation.

These partners handle routine tasks like accounts payable and reconciliations, enabling finance teams to focus on improving guest experience. By integrating tools like AI, automation, and cloud platforms, they accelerate digital adoption, reduce costs, and enhance scalability. Such partnerships ensure streamlined operations, better data visibility, and a future-ready finance function tailored to the evolving demands of the industry.

Executing the Transformation

To maximize the benefits of finance digital transformation, finance leaders should:

- Start Small: Focus on automating the most time-consuming tasks first, like AP/AR.

- Measure ROI: Track key metrics to assess the impact of digitization, such as cost savings, error reduction, and process efficiency.

- Partner with Experts: Collaborate with partners with niche expertise to maximize the ROI.

These strategies, when implemented cohesively, can help hospitality businesses streamline operations, improve financial health, and focus on delivering superior guest experiences.

Introducing QX’s Software Suite and Transformative Outsourcing Approach

At QX Global Group, we understand the unique challenges faced by hospitality finance leaders. Our tailored solutions are designed to help you digitize and optimize your operations, empowering your teams to focus on strategic growth. Here’s what we offer:

- MailerDesk: Enhances query management by auto-assigning and tracking email tickets, securely storing data on the cloud for instant access.

- VMSBot: Automates data handling by generating, formatting, and uploading reports across ERP systems, while detecting duplicates and missing bookings.

- ProAR (Accounts Receivable): Simplifies cash applications with real-time remittance data extraction, bulk uploads, and streamlined invoice retrieval.

- ProAP (Accounts Payable): Streamlines invoice workflows by extracting details, processing bulk uploads, and integrating with accounting tools like Xero and Yardi.

- Procurely: Optimizes procurement with purchase order tracking, multi-currency support, and automated invoice and document management.

- SpendChex: Automates expense management with multi-currency tracking, approval workflows, and advanced features for recurring expenses.

Why Partner with QX?

Our transformative outsourcing approach combines cutting-edge technology with deep industry expertise. With a dedicated team of over 2,000 qualified accountants, we act as an extension of your business, delivering measurable results.

Conclusion

Finance digital transformation is no longer optional—it’s essential for hospitality businesses aiming to thrive in 2025 and beyond. By embracing advanced technologies, adopting data-driven strategies, and collaborating with trusted partners, finance leaders can overcome challenges, unlock efficiencies, and drive sustainable growth.

Ready to transform your finance operations?

Let’s discuss how QX Global Group can support your journey and make 2025 your most successful year yet.

Originally published Dec 18, 2024 11:12:31, updated Mar 06 2025

Topics: Finance and Accounting Outsourcing Services, Hospitality Accounting