Topics: Finance and Accounting Transformation, Senior Living

Financing the Future of Retirement Living: The Path Beyond Building More Homes

Posted on December 09, 2024

Written By Miyani Lourembam

The retirement living sector in the UK is at a pivotal moment, with an ageing population driving demand for housing that caters to older adults’ specific needs. By 2040, the number of people aged 75 and older is expected to rise by 38%, reaching nearly 9 million individuals. Yet, the market is falling woefully short, delivering just 7,340 retirement housing units per year—far below the 50,000 units recommended annually to meet demand, as highlighted in the JLL UK Seniors Housing Report Q3 2024. With only 3% of new housing completions explicitly designed for retirees, the sector faces a critical undersupply, leaving many seniors without suitable housing solutions.

Retirement living growth strategies must evolve to meet these challenges. Traditional approaches to simply building more homes fail to address the diverse needs of older adults. Developers and investors need to focus on innovative models to create communities that are financially viable, socially impactful, and aligned with future demands. This blog explores five actionable strategies for unlocking opportunities in retirement living and ensuring its long-term growth.

1. Build on the Growth of Integrated Retirement Communities

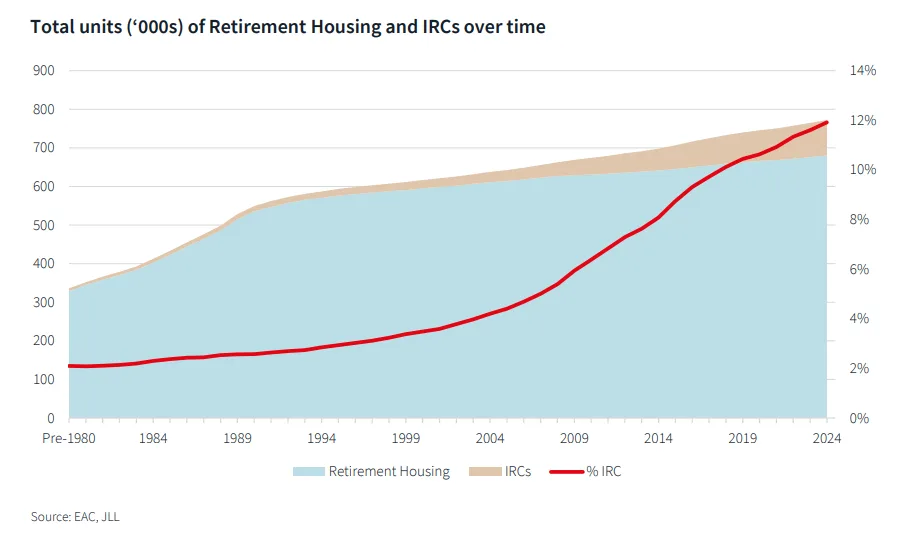

Integrated Retirement Communities (IRCs) have experienced a 19.1% growth over the past five years, underscoring their increasing appeal as a comprehensive solution for senior living. These communities combine independent housing, wellness services, and healthcare support in a single location, enabling residents to age in place while enjoying a high-quality lifestyle. For operators, developers, and investors, IRCs represent a scalable and resilient model that aligns with the evolving preferences of seniors.

Market Appeal

- IRCs cater to the growing demand for retirement living options that combine housing, care, and lifestyle services in one location.

- The growth trajectory of IRCs highlights their ability to attract a diverse resident base while offering long-term operational stability.

- Comprehensive service offerings in IRCs create multiple revenue streams, making them attractive to investors seeking resilient and scalable opportunities.

It will be a good strategy to prioritise the development of IRCs that offer seamless transitions between independent living, assisted living, and nursing care, ensuring residents can age in place without leaving the community. Incorporate wellness programs, communal spaces, and recreational amenities that enhance quality of life and foster social connections among residents. Partnering with healthcare providers and wellness professionals is essential to deliver integrated care and health services tailored to residents’ needs. Scalability should also be a key consideration, with IRC designs allowing for future expansions and upgrades to meet growing demand.

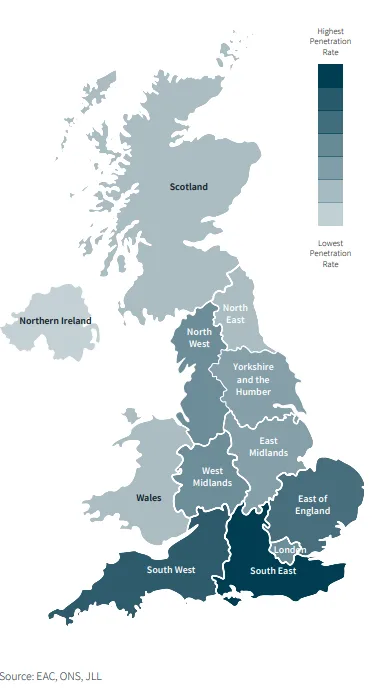

2. Expand into Underserved Regions with Low Market Penetration

Retirement housing developments have traditionally been concentrated in affluent areas, but significant opportunities exist in underserved regions with ageing populations and low market penetration. Some regions show penetration rates as low as 6.8%, highlighting untapped potential for operators, developers, and investors willing to expand beyond established hubs. Targeting these areas can address demand while improving housing equity for seniors.

Why It Works

- Expanding into underserved regions helps address latent demand and supports housing equity for seniors in less developed areas.

- Lower land and construction costs in these regions improve development margins, making projects more financially viable.

- Governments often provide planning and financial incentives to encourage investments in these areas, reducing upfront barriers for developers and operators.

For this one, it is important to conduct detailed market research to identify regions with ageing populations and limited access to retirement housing. Tailor developments to local demographics and cultural preferences to establish a stronger connection with the community. Collaboration with local authorities is essential to navigate planning processes, unlock incentives, and secure funding support. Smaller, community-oriented developments are particularly effective in these regions, providing scalable solutions that address localised needs while delivering solid returns.

3. Capture Opportunities in Affluent Senior Markets

With 68% of over-75s being affluent, a growing demand for premium retirement living options exists. Affluent seniors are looking for communities that align with their lifestyle expectations, offering high-end amenities, wellness services, and integrated care. Developers and investors can leverage retirement living investment trends by designing high-end communities with luxury amenities. These developments appeal to a demographic willing to invest in premium housing that reflects their lifestyle expectations.

Key Benefits

- Affluent seniors are more likely to invest in premium retirement communities, driving demand for high-quality housing and services.

- Premium developments generate higher margins for developers and operators through upscale amenities and care services.

- The wealth concentration among seniors ensures consistent demand for luxury offerings in well-connected, desirable locations.

Designing retirement communities with premium amenities, such as fitness centres, spas, fine dining options, and concierge services tailored to the preferences of affluent residents, could be advantageous. Selecting locations in well-connected urban or suburban areas with access to cultural, recreational, and healthcare facilities is crucial. Also, invest in marketing strategies highlighting exclusivity, lifestyle benefits, and the long-term value of premium retirement living to attract this demographic.

4. Offer Flexible Tiered Care Models

Modern retirement communities must go beyond static housing to provide a continuum of care. This approach enables residents to move seamlessly between levels of support—independent living, assisted living, and skilled nursing—without relocating to a new facility.

Strategic Advantages

- Residents value the ability to age in place, knowing they won’t need to uproot their lives as their needs evolve.

- Operators benefit from long-term resident retention, reducing turnover and vacancies.

- Investors appreciate the predictable revenue streams from residents staying in the same community while accessing more services over time.

Communities should prioritise adaptable layouts that allow for seamless expansion of care services, enabling independent living units to be converted into assisted living or nursing care facilities when required. Strong partnerships with care providers ensure specialised services are readily available and scalable. Additionally, integrating wellness programs that support residents’ physical and mental health can delay the need for higher levels of care, enhancing overall satisfaction and loyalty while increasing the community’s appeal.

Building Financial Resilience for the Future of Retirement Living

The future of retirement living lies in embracing innovative strategies that address the diverse needs of an ageing population. Integrated Retirement Communities, regional expansion, premium senior markets, and flexible tiered care models offer significant opportunities for developers, operators, and investors. However, the success of these strategies hinges on sound financial management and the adoption of innovative financing in retirement housing.

Streamlining financial processes, improving cash flow management, and leveraging accurate forecasting are critical for ensuring long-term growth. Operators and developers must prioritise sustainable practices and efficient resource allocation to reinvest in developments and upgrades that enhance resident satisfaction. By optimising financial operations, stakeholders can achieve resilience and take a positive step toward future-proofing retirement communities and meeting the evolving demands of the ageing population.

How QX Can Help

At QX Global Group, we specialise in finance and accounting services designed to help operators, developers, and investors achieve their growth objectives. Whether streamlining back-office operations, improving cash flow visibility, or delivering accurate financial forecasting, our expertise ensures you can focus on building communities that matter. With proven solutions for the retirement living sector, we help you optimise processes, reduce inefficiencies, and scale your business sustainably.

Ready to transform your financial operations and take your retirement living business to the next level? Connect with us today to explore how we can partner in your success.

Originally published Dec 09, 2024 06:12:07, updated Mar 06 2025

Topics: Finance and Accounting Transformation, Senior Living