Topics: Finance & Accounting Outsourcing, Hospitality Accounting

How an Outsourced Finance Team Optimises Hotel Operations

Posted on June 08, 2024

Written By Priyanka Rout

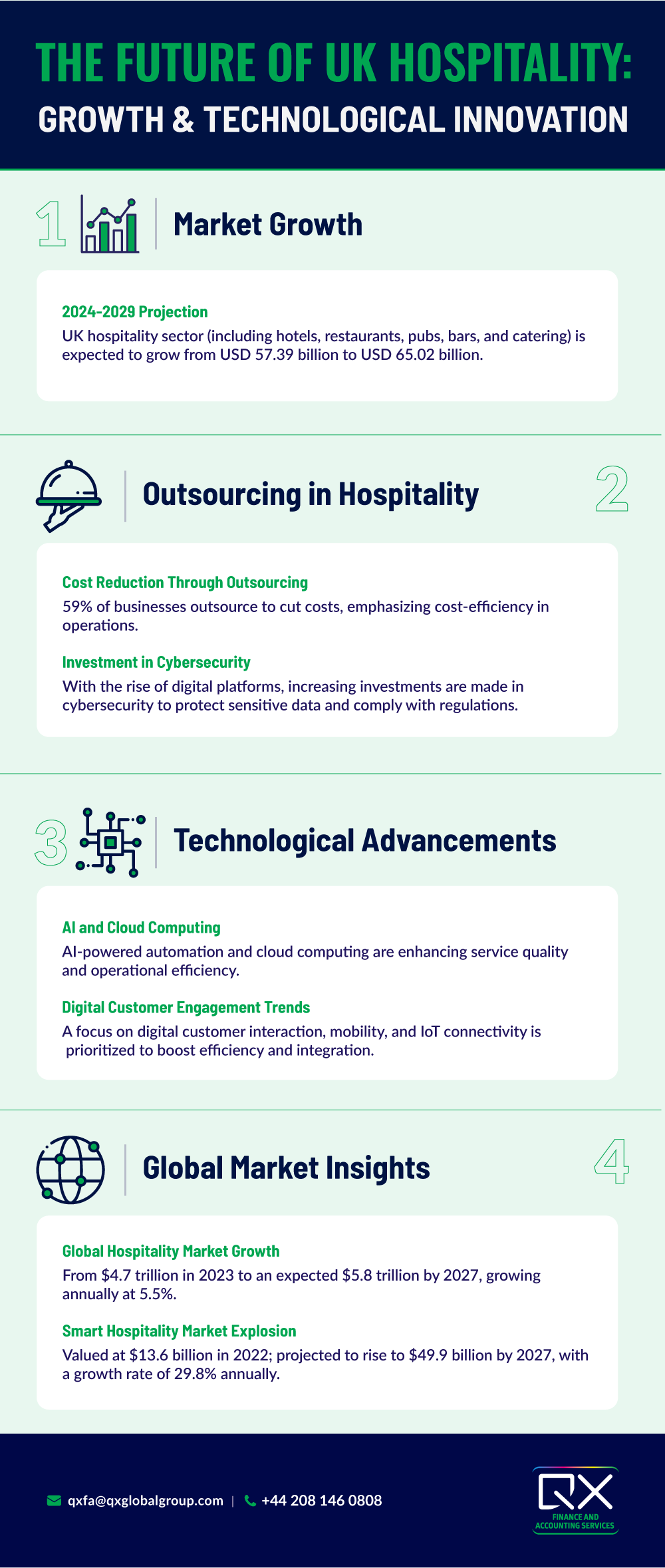

The hospitality sector in the UK, which encompasses hotels, restaurants, pubs, bars, and catering, is projected to increase from USD 57.39 billion in 2024 to USD 65.02 billion by 2029. This growth represents an annual rate of 2.53% over five years.

As a vital part of the UK economy, this industry not only employs millions but also makes a significant contribution to the GDP. Investment in this sector has been growing, bolstered by strong performance metrics.

In London, these performance indicators are even more favourable than in other parts of the country, reflecting a robust demand for new hotel developments, especially with the influx of travellers. Despite the uncertainties brought about by Brexit affecting investments, the sustained demand continues to draw investors.

Additionally, the rise of serviced apartments and shared living spaces has been making cities like London more accessible to millennials and younger travellers, adding to its appeal as an affordable destination.

At the same time, the hospitality industry faces a set of distinct financial challenges, from fluctuating demand and high operating costs to stringent regulatory requirements. Navigating these financial complexities often stretches the internal resources of many businesses in this sector thin.

One viable solution that has gained traction is an outsourced finance team for the hospitality industry. This approach not only helps streamline financial operations but also enhances financial reporting and compliance, allowing hoteliers and restaurant owners to focus more on guest satisfaction and operational efficiency.

In this blog, we’ll explore how outsourced accounting for the hospitality industry can be a strategic advantage in managing the intricate financial landscape.

What is an Outsourced Finance Team in the Hospitality Industry?

An outsourced finance team in the hospitality industry is like having your own financial experts, just not on your payroll. These professionals work for an external company and handle everything from your day-to-day accounting and payroll to making sure you’re on the right side of financial laws and regulations.

This setup allows hotels and restaurants to focus more on looking after their guests and less on the numbers. It’s a smart way to tap into advanced financial tools and expertise without the hefty cost of setting up an in-house team.

6 Benefits of Outsourcing Finance Operations

1) Reduce Operating Costs

A significant motivation for outsourcing is cost reduction. Approximately 59% of businesses outsource primarily to cut costs. This is especially relevant in finance and accounting, where outsourcing can help manage expenses without compromising service quality.

Outsourcing accounting for hospitality businesses can significantly reduce operational costs. In-house accounting requires hiring, training, and maintaining a full-time staff, which includes salaries, benefits, and overhead expenses. Outsourcing, on the other hand, offers a more cost-effective solution.

By outsourcing, businesses can convert fixed costs into variable costs, paying only for the services they need when they need them. This flexibility can lead to substantial savings, particularly for small to medium-sized enterprises.

In-house accounting might necessitate the investment in expensive software and ongoing professional development, while outsourcing provides access to these resources without the hefty price tag.

Learn why it’s crucial for hospitality leaders to address wage increases now—read our insights on the cost of inaction.

2) Scalability

Outsourcing accounting for hospitality provides a scalable solution that can grow with your business. Hospitality businesses often experience seasonal fluctuations, and outsourcing offers the flexibility to adjust the level of services according to demand.

For example, during peak seasons, an outsourced team can scale up to handle increased transactions and financial activities. Conversely, during off-peak times, services can be scaled down to save costs. This adaptability ensures that your accounting needs are always met without the burden of maintaining a full-time staff year-round.

3) Access to Expertise

As digital reliance grows, data security has become a paramount concern in outsourcing, prompting businesses and their partners to bolster cybersecurity measures and comply with regulatory standards.

The hospitality industry faces complex financial regulations, and outsourced accounting firms provide the necessary expertise to ensure compliance, thus reducing the risk of legal issues and fines. These firms stay current with regulatory changes, allowing swift implementation of adjustments.

Outsourcing enables businesses to focus on core operations, mitigating financial risks and regulatory burdens. Moreover, accessing specialised knowledge through outsourced accounting professionals enhances financial decision-making, offers strategic insights, identifies cost-saving opportunities, and improves overall financial performance within the hospitality sector.

4) Focus on Core Business Operations

Outsourcing accounting for hospitality allows management to concentrate on core activities such as improving guest services and developing new offerings. By delegating the complex and time-consuming accounting tasks to professionals, managers can focus on enhancing the guest experience and growing the business.

For instance, a hospitality business that outsourced its accounting reported increased efficiency and guest satisfaction. With more time and resources available, the management could invest in staff training and service improvements, leading to higher guest retention and positive reviews.

5) Technological Advantages

AI-powered automation and cloud computing are becoming crucial in outsourcing, enhancing service quality and operational efficiency. For instance, AI-driven tools like predictive analytics are increasingly used to optimise resources and improve decision-making processes.

Outsourcing accounting functions helps the hospitality industry reduce operational costs by eliminating the need for in-house accounting staff and leveraging the expertise and technological efficiencies of specialised firms.

These technologies include automation tools, cloud-based accounting systems, and real-time data access, which streamline accounting processes and improve accuracy.

The use of advanced technology also enhances data security and facilitates better financial analysis and reporting. Businesses benefit from faster transaction processing, improved data accuracy, and the ability to make informed decisions based on real-time financial information.

6) Improved Financial Health and Strategic Planning

Outsourcing accounting for hospitality businesses can significantly contribute to its financial health and strategic planning. Outsourced accounting teams leverage advanced tools to provide accurate, timely financial reports, enhancing transparency and decision-making clarity.

This not only builds trust with investors and stakeholders but also offers comprehensive insights into financial performance, highlighting areas for improvement. Detailed analyses and projections from these professionals aid in strategic planning and align financial strategies with business goals, thereby supporting sustainable growth and profitability in the hospitality sector.

How Can Outsourcing Give You a Competitive Advantage?

Communication and Integration

The integration of digital technologies in the hospitality industry is crucial for seamless operations, especially when coordinating with outsourced finance teams. A recent study by eHotelier highlights that hotels are prioritising areas like digital customer engagement, mobility, and connectivity through the Internet of Things (IoT) to enhance operational efficiency and integration.

The adoption of digital technologies not only streamlines communication but also supports better integration with external teams by providing real-time data and automated processes. This digital transformation is essential for overcoming geographical and operational barriers that often come with outsourcing.

Quality Control and Security

In 2023, the global hospitality market reached $4.7 trillion. It is expected to grow to $5.8 trillion by 2027, with an annual growth rate of 5.5 percent. This growth is driven in part by the rising use of digital technology.

Cybersecurity remains a significant concern in the hospitality sector, with ongoing threats that necessitate robust security measures.

Outsourced accounting for hospitality can play a critical role in enhancing cybersecurity by bringing in specialised expertise and advanced technology. By leveraging the latest security protocols and compliance standards, outsourced teams help safeguard sensitive financial data against potential cyber threats.

This collaborative approach ensures that quality control and security measures are not compromised, thereby maintaining trust and integrity in financial operations.

Implementing an Outsourced Finance Team in Your Business

Implementing an outsourced accounting for hospitality involves integrating skilled professionals from an external organisation to manage financial tasks and responsibilities traditionally handled internally.

This approach can lead to significant cost savings, enhanced efficiency, and access to specialised expertise without the overhead associated with a full-time finance department.

Explore our guide on best practices for managing high-volume transactions effectively in hospitality finance.

Future Trends in Financial Outsourcing for Hospitality

The hospitality industry is increasingly turning to financial outsourcing as a strategic move to streamline operations and reduce costs. Recent forecasts suggest a continued growth trajectory in this area.

The global Smart Hospitality Market was valued at $13.6 billion in 2022. It’s expected to grow to $49.9 billion by 2027, with an annual growth rate of 29.8%. This market is expanding due to the rise in tourism and more investments in hotel projects.

Additionally, there’s an increasing demand for guest-focused, highly personalised, and real-time optimised experiences, which will further drive the growth of the smart hospitality market.

Key factors contributing to this growth include the rising demand for specialised financial expertise and the adoption of scalable solutions that outsourcing offers to hospitality businesses dealing with seasonal fluctuations.

Summing Up!

Outsourced finance teams in the hospitality sector enhances operational efficiency, reduces costs, and improves financial transparency, allowing businesses to focus on improving guest experiences. Outsourcing accounting for hotels, restaurants, and clubs can bring in a lot of advantages that are listed above in the blog.

QX Global Group specialises in transitioning companies from manual to advanced digital processes, with a dedicated team of expert accountants proficient in these technologies.

Partnering with us delivers long-term operational efficiencies and cost savings, strengthening your market position. Contact us to discover how our tailored solutions can elevate your business and unlock your full potential.

Outsourced finance teams usually take care of the nitty-gritty like keeping the books, handling payroll, making sure taxes and compliance are spot on, and they often help with budgeting and financial strategy too. They’re pros at spotting ways to cut costs and boost revenue, and they’ll help you make sense of financial trends so you can plan your next big move with confidence. Focus on finding a team with a strong hospitality background, a proven track record, quick response times, and the tech savvy to mesh seamlessly with your operations. They use top-notch software to keep everything accurate and compliant, crafting detailed financial reports and guiding you smoothly through any audits. FAQs

What services do outsourced finance teams in the hospitality industry typically provide?

How can outsourced finance teams assist with financial planning and analysis?

What should hospitality businesses look for when choosing an outsourced finance team?

How do outsourced finance teams handle financial reporting and audits?

Originally published Jun 08, 2024 03:06:53, updated Feb 21 2025

Topics: Finance & Accounting Outsourcing, Hospitality Accounting