Topics: Accounts Receivable Automation

Posted on November 17, 2021

Written By

Rukmani Krishna

The accounts receivable (AR) function has a significant impact on a business’ revenue and cash flow, making it extremely vital for any business. An efficient AR process will ensure timely payments, better client relationships, and enhanced liquidity. However, many businesses tend to follow non-optimized AR processes which leads to hampered efficiency, unhealthy cash flows and high operational costs.

We have compiled seven easy ways in which you can optimize your accounts receivable function.

1) Switch to electronic billing & payments: Manual, paper-based processing is still used in several organizations. This method can be extremely time-consuming and expensive in the long run, along with being prone to human errors.

An electronic invoicing and payment system speeds up the process and makes online payments easier. It’s important to integrate your billing and payment systems as this will lead to better accuracy, keep track of invoices and payments, and even customize payment reminders and follow-up messages.

2) Simplify the payment experience: Customer-centricity should be the prime focus while building your digital payment platform. If your platform is not user-friendly, it can deter customers from making payments. It’s vital that you build a seamless payment platform that is quick, reliable, and flexible. Long loading times, a cluttered interface, and frequent time outs can ruin the customer experience.

Therefore, your payment platform should be responsive in nature and have preloaded assets. Additionally, offering smart inputs can improve the customer experience and enable them to better navigate and locate relevant details regarding their payments.

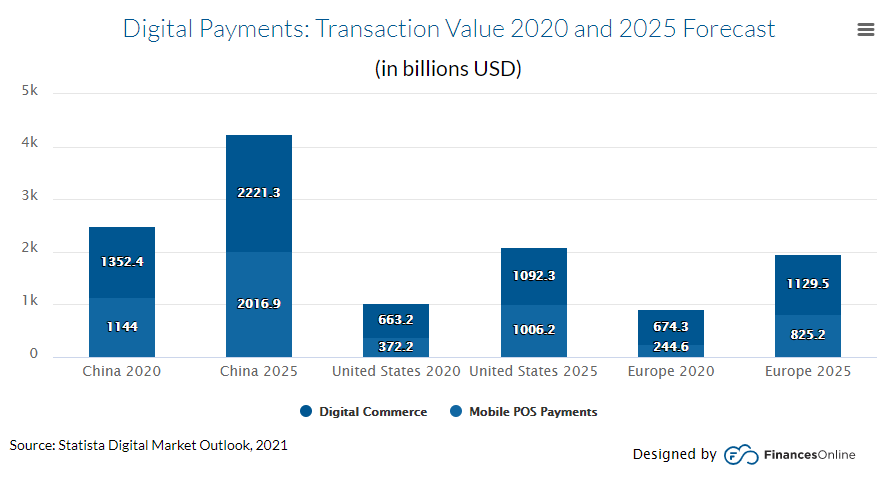

3) Offer multiple payment channels: Not all users use a desktop or laptop to make payments. Today, several users prefer contactless payments through their smart phones. Therefore, your payment platform should offer various payment options like digital payments, pay by text, and app-based payments among others. Flexibility in payment options can improve your collection speed and offer a better user experience for your customers.

4) Offer automatic payments: A good way to reduce late payments is by offering an automatic payment option via a payment gateway. Electronic invoicing allows instant billing, better accuracy, and easier tracking of incoming payments. You can also use e-invoicing to schedule payment reminders via email, text, phone calls, and other communication channels. This offers transparency and flexibility for your customers.

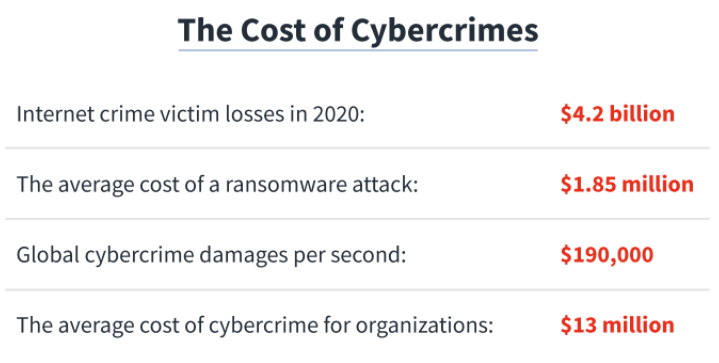

5) Provide a secure payment platform: Data security is a key concern for both businesses and customers. Therefore, it is important to develop and implement guidelines and policies for your payment platform. As a business, you should focus on implementing strong securities measures that ensure that customer data is safe and secure.

6) Offer payment incentives: One of the easiest ways to encourage quicker payments is by offering payment incentives to your customers. Early payment discounts can motivate customers to make payments before the due date. However, offering positive customer incentives is not enough; negative incentives should also be shared to deter late payments.

For example, charging interest on late payments could make your customers pay on time. However, it’s important to communicate negative incentives in a way that doesn’t strain relations with your customers.

7) Conduct credit evaluations: A best practice that every business should follow is checking the credit history of potential customers. This will help in weeding out potential customers who have a history of frequent non-payments or late payments. Establishing clear payment terms and informing customers upfront before providing any services is another best practice that your business must incorporate.

Related Case Study: QX worked with a leading recruitment agency to transform accounts receivable and credit control functions. Read the story here.

An efficient accounts receivable function is a must for any organization. A non-optimized AR process can lead to revenue loss, delayed payments, and put excessive strain on resources. Switching to digital payments can help your business improve its cash flow, reduce costs, and enhance customer relationships.

Are you on the lookout for a partner who can help transform your accounts receivable function? Get in touch with our experts for personalized advice on how to transform your accounts receivable function.

Originally published Nov 17, 2021 09:11:33, updated Apr 17 2024

Topics: Accounts Receivable Automation