Topics: Student Housing

Posted on September 07, 2017

Written By

QX Global Group

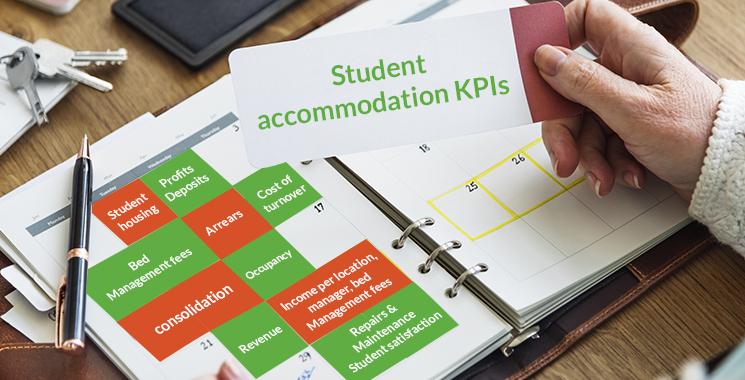

The student accommodation industry is experiencing consolidation through mergers and acquisitions. However, the legacy of a fragmented operational model lingers on. To streamline operations, boost revenue growth and to ensure that set targets are met, property managers and owners must keep an eye on the following KPIs:

Occupancy rates for student accommodation one of the most efficient and straightforward metrics to assess the operational efficiency and performance of any site or property is occupancy rates. Student housing occupancy rates can be impacted by a number of factors such as; the location of the site, travel facilities, standard of the housing, efficiency of sales & marketing functions, and rental rates (high or low). The data of year on year growth or decline in the percentage of occupancy can be a powerful tool for measuring the expected cash flows for the near future and for discovering opportunities of growth through development or acquisition of new sites in specific locations.

RELATED BLOG: In addition to being a key KPI for PBSA companies, occupancy rates is also looked at closely by BTR businesses to evaluate their properties’ performance. Read this blog to know what metrics BTR professionals analyze to understand their profitability, liquidity, solvency, and efficiency.

Contracts for student accommodation are normally limited to the length of the active school year. This means there will be substantial time when the units won’t be utilized. In addition to vacancy losses, preparing the vacated property includes the cost of apartment preparation, marketing & advertising, utilities and more. One of the better methods to reduce average-days-to-lease is to win renewals of contract from the students; another effective approach is winning new tenants for a short or medium term during summer vacation.

Student tenants have a reputation of being harder on apartments than other tenants. Over the course of a year, the need for all kinds of repairs and maintenance will arise. Finding out the exact spending on this line item can be instrumental in uncovering avoidable expenses. For example, if you manage a large portfolio of properties, but the repair and maintenance is contracted or subcontracted to local firms, a comparative analysis can help you identify spending that is way above the average. Based on the insights you glean from the data, you could decide to try a different maintenance company for a specific location, or contract the work for all the locations to the one maintenance provider that has proven trustworthy and cost-effective.

The student housing sector caters to a community of young people, typically aged 18-25 (with some older students in post-graduation and research). They are often connected to each other, are tech savvy, prefer mobiles to desktops, wary of advertising, and experts at comparison shopping. Word-of-mouth and social media will play a large role in how a particular student housing property or company is viewed. So, it is essential that your student tenants are satisfied with your services. Periodic student satisfaction surveys via social media, online channels and physical surveys are necessary to gauge the student sentiment. Highlight positive feedback and weave it with the marketing message and take action on negative feedback.

The student housing sector has shown remarkable dynamism in the past few years. As this sector continues to consolidate through mergers and acquisitions, property management companies are likely to win and lose properties. In order to reduce the churn, property management companies must identify the reasons for losing any properties and strive to convert their weaknesses into strength. At the same time, property managers must understand the factors that allowed them to win a new property and build upon their strengths.

RELATED CASE STUDY: QX worked with a leading student housing provider in the UK to deliver end-to-end F&A outsourcing solutions that helped improved efficiency and reduce operational costs by 50%. Read the case study to learn more about this partnership.

For companies that own or manage a large number of student housing across locations, detailed reports on the average income generate per bed, categorized by location, facilities, standard of living and property manager can be instrumental in measuring, understanding and improving the performance of the entire portfolio. For instance, by using such reports it’s possible to discover what each property manager is doing well. The information around the best practices followed by one manager can be shared within the entire organization, helping raise the overall performance. Of course, in order to arrive at a reliable and realistic figure, you must compare apples to apples!

Property management firms specializing in the sector are often the natural choice for owners of student housing portfolios. However, it is imperative for the investors to keep an eye on the fees charged on monthly/annual revenue. Is the charge similar to the market-norm, or is it significantly higher than the average – considering the services provided? Similarly, property managers must also check competition and the market average to ensure that they are charging enough for their services. The percentage of fees charged can change when the level and quality of the service improves or declines.

Year on year revenue growth is a powerful indicator of the overall performance of a student housing portfolio. By analyzing the in-depth data on the growth or decline in the revenue, it is possible to identify the key contributors to the growth. For instance, the revenue may have increased due to the fall in the repair and maintenance costs, while the rents have increased. Or it could be the rise in rents has not kept pace with inflation, which has led to a decline in revenue growth. Also, student housing management companies tend to focus on the revenue generated through leases as it helps to get a whole picture which includes revenues from other sources, e.g. rent for using facilities, food, utilities, parking, etc. Again, by comparing the revenue growth across sites, it is possible to recognize fresh revenue generation opportunities.

As demonstrated in the above points, analyzing the key KPIs on a periodic basis can help student housing owners, investors and managers make tactical course corrections and take wide-reaching strategic decisions to secure future growth. For this to become possible, it is necessary to have accurate and timely financial reports.

But that is easier said than done in a market that is witnessing rapid growth through mergers and acquisitions. As a specialist student accommodation accounting services provider we have seen that, in many cases, property managers across sites use diverging accounting and reporting processes – this is especially true when it comes to recently merged businesses. How can this situation be remedied? Read a real-life story of how one of the leading student accommodation providers managed to consolidate accounting and reporting for a large and diverse portfolio.

Originally published Sep 07, 2017 12:09:25, updated Apr 16 2024

Topics: Student Housing